50% Off All

Education Courses

Happy Financial Literacy Month!

Enjoy half off all education courses

with code: LITERACY

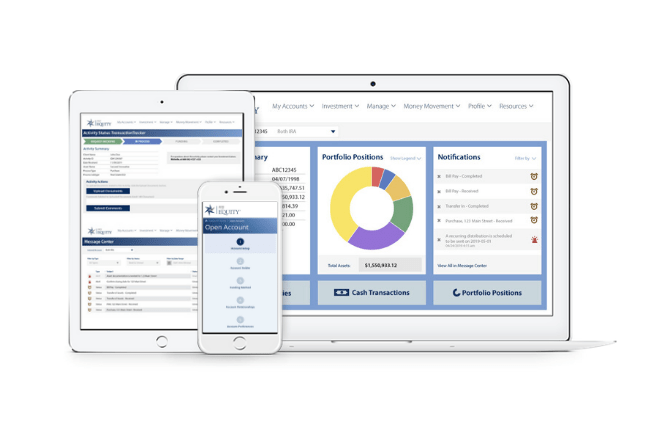

myEQUITY provides a faster, easier way to invest and manage your account

LOG INTO myEQUITY

myEQUITY makes it easy for you to invest and manage your account with intuitive online wizards and a clear line of sight to account data, with around-the-clock access from any device.

Transaction requests (such as Bill Pay, Distributions and Purchases in Real Estate and Private Debt) can now be initiated within myEQUITY.com.

LOG INTO myEQUITY

Login to myEQUITY.com to initiate a transaction request through an easy-to-follow online wizard, and track the status of your request in real time.

Simply go to the Transaction Launcher within myEQUITY to upload completed forms and submit your request. After submission, an activity ID is provided to track processing, with the live, up-to-date status viewable in the Transaction Tracker.

Forms to manage every aspect of your Equity Trust account are just a click away. If you need assistance with any form, our Client Service Team is available to help.

PLEASE NOTE: Any and all expenses associated with your investment that require a bill pay to occur must be paid out of your IRA account.

You are leaving trustetc.com to enter the ETC Brokerage Services (Member FINRA/SIPC) website (etcbrokerage.com), the registered broker-dealer affiliate of Equity Trust Company. ETC Brokerage Services provides access to brokerage and investment products which ARE NOT FDIC insured. ETC Brokerage does not provide investment advice or recommendations as to any investment. All investments are selected and made solely by self-directed account owners.

Continue