50% Off All

Education Courses

Happy Financial Literacy Month!

Enjoy half off all education courses

with code: LITERACY

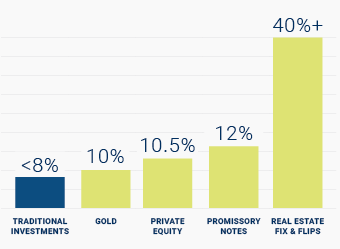

Alternative investments are assets that fall outside the realm of traditional investments. Not correlated to the markets, these assets enable you to to diversify your portfolio because of their unique characteristics and risk profiles. Discover the many types of alternative investments that can be held in a retirement account.

Changing your investment strategy to include alternative investments can dramatically expand your horizons, both from a return-on-investment and diversification perspective.

What are you investing for? Whether your “why” is retirement, healthcare expenses, or a loved one’s education, we make the journey easy with innovative technology and first-class service.

Access your exclusive, free guide for an extensive list of traditional and alternative investment options for your account, plus how to get started.

Browse the tax–advantaged accounts and find one that matches your savings goals – from retirement to education to health care savings.

Discover what you need to know before you make your first investment, including investments not allowed in an IRA and how much you can contribute to your account.

Ready to Get Started?

Our knowledgeable IRA Counselors can answer your questions about the self-directed investing process and share insight and education about our self-directed accounts to help you decide what options may be best for you.

By entering your information and clicking Start a Conversation, you consent to receive reoccurring automated marketing text messages and emails about Equity Trust’s products and services. This consent is not required to obtain products and services. If you do not consent to receive text messages and emails from Equity Trust and seek information, contact us at 855-233-4382. Reply STOP to opt out from text messages. Message and data rates may apply. View Terms & Privacy.

You are leaving trustetc.com to enter the ETC Brokerage Services (Member FINRA/SIPC) website (etcbrokerage.com), the registered broker-dealer affiliate of Equity Trust Company. ETC Brokerage Services provides access to brokerage and investment products which ARE NOT FDIC insured. ETC Brokerage does not provide investment advice or recommendations as to any investment. All investments are selected and made solely by self-directed account owners.

Continue