Become a

Smarter

Investor

in 15 Minutes

Free guide helps you unlock the potential

of your retirement account

– all before you

finish a cup of coffee.

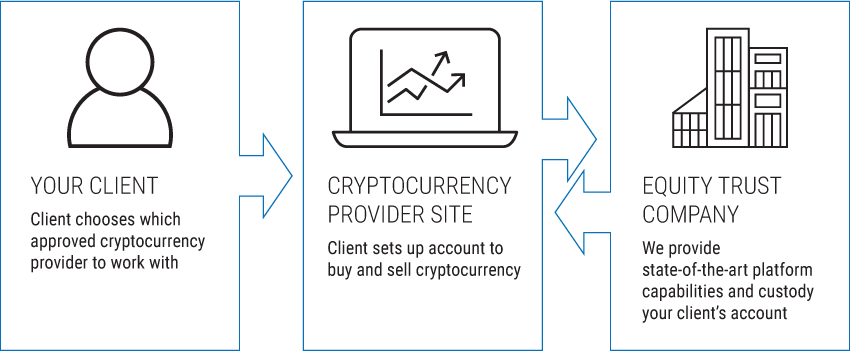

Cryptocurrency is one of the many assets investors can hold in a tax-advantaged Equity Trust Company Traditional or Roth IRA.

Equity Trust Company’s state-of-the-art platform, combined with customized service from leading providers, offers a simplified experience. With Equity Trust Company as your clients’ cryptocurrency IRA custodian, they benefit from one of the industry’s most advanced platforms, which offers:

In addition to the features listed above, your clients receive access to industry-leading cryptocurrency providers and an investing experience customized to their comfort level. They may choose from the companies listed on our provider page to begin the account-open process or start investing through the provider’s website. Your clients receive the unbeatable combination of Equity Trust’s industry-leading cryptocurrency platform and account custody, plus the service and expertise only these providers can offer.

Visit our provider page to help your client choose how they will start investing in cryptocurrency within their Equity Trust IRA.

CHOOSE A PROVIDER

Attract more IRA investor business with our state-of-the-art cryptocurrency platform and custody services. Our industry-leading API and white-label solutions make it easy for you and your clients.

Learn more now – Contact Business Development Manager Kurt DeVries at [email protected]

You are leaving trustetc.com to enter the ETC Brokerage Services (Member FINRA/SIPC) website (etcbrokerage.com), the registered broker-dealer affiliate of Equity Trust Company. ETC Brokerage Services provides access to brokerage and investment products which ARE NOT FDIC insured. ETC Brokerage does not provide investment advice or recommendations as to any investment. All investments are selected and made solely by self-directed account owners.

Continue