50% Off All

Education Courses

Happy Financial Literacy Month!

Enjoy half off all education courses

with code: LITERACY

News and Trends

See All Posts

See All Posts

on24.com – Available to view now! – | | Jan 01

on24.com – Available to view now! – | | Jan 01

on24.com – Available to view now! – | | Jan 01

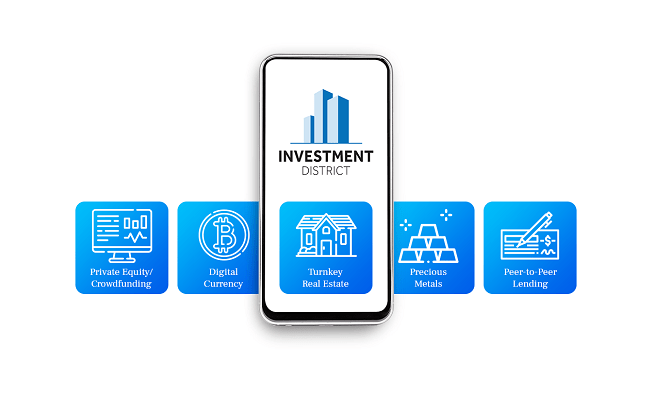

It’s now easier than ever to find the most in-demand investment opportunities for your self-directed account. Introducing Investment District, where you can browse and choose from high-end platforms and providers in the cryptocurrency, lending, precious metals, private equity/crowdfunding, and turnkey real estate asset classes.

Locate an Investment OpportunityBlog

Customer Reviews

Client Stories

Video Resource Center

Forms

Fraud & Scam Prevention

Contribution Limits

Retirement Calculators

Get answers to common questions about self-directed IRAs, real estate in an IRA, transferring an account, and more.

VIEW ALL FAQSWhat are the advantages of opening a self-directed IRA?

What types of accounts does Equity Trust offer?

What investment options are possible with an Equity Trust account?

Let’s talk about your financial future.

Schedule a one-on-one session with an expert alternative investment counselor. We’re here to answer any questions, help guide you through the process, and provide more detailed information and education specific to your journey.

By entering your information and clicking Start a Conversation, you consent to receive reoccurring automated marketing text messages and emails about Equity Trust’s products and services. This consent is not required to obtain products and services. If you do not consent to receive text messages and emails from Equity Trust and seek information, contact us at 855-233-4382. Reply STOP to opt out from text messages. Message and data rates may apply. View Terms & Privacy.

You are leaving trustetc.com to enter the ETC Brokerage Services (Member FINRA/SIPC) website (etcbrokerage.com), the registered broker-dealer affiliate of Equity Trust Company. ETC Brokerage Services provides access to brokerage and investment products which ARE NOT FDIC insured. ETC Brokerage does not provide investment advice or recommendations as to any investment. All investments are selected and made solely by self-directed account owners.

Continue