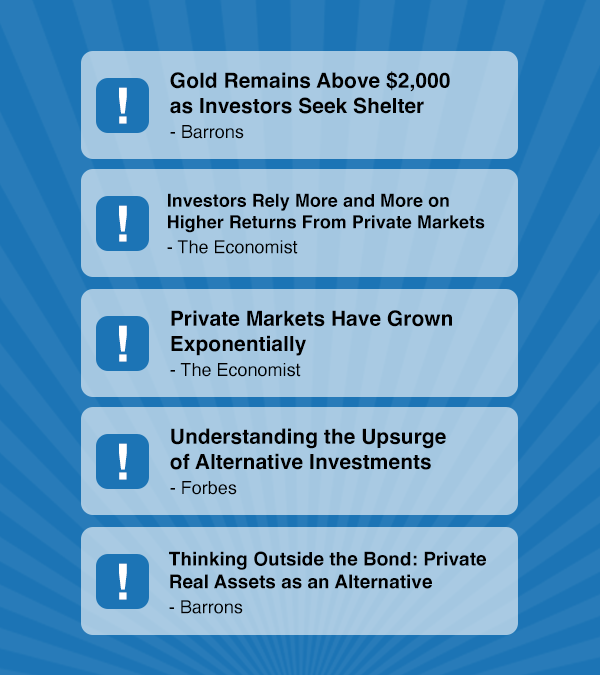

Headlines Spell Out Troubling Times for Investors Nearing Retirement

Do you count yourself among those concerned about whether your nest egg will weather the latest “perfect storm” of economic uncertainty? Will your portfolio withstand the double threat of sliding stocks and inflation?

News About Alternative Investments Brings Hope

Alternative investment performance has provided an option for those who want to hedge against factors against their control, such as stock performance or inflation. Plus, when held in an IRA or other retirement account, investments grow tax-free.

We hear story after story about investors who have retired sooner than they thought possible because they diversified their IRA to reduce their exposure to stock market volatility, beat inflation, and reduce their tax burden.

Don’t Wait for Your Retirement Account To Dip Further Before You Take Action

Discover if alternative investments could help you weather an economic storm.

Talk to an IRA Counselor today to find out if this strategy could work for you.

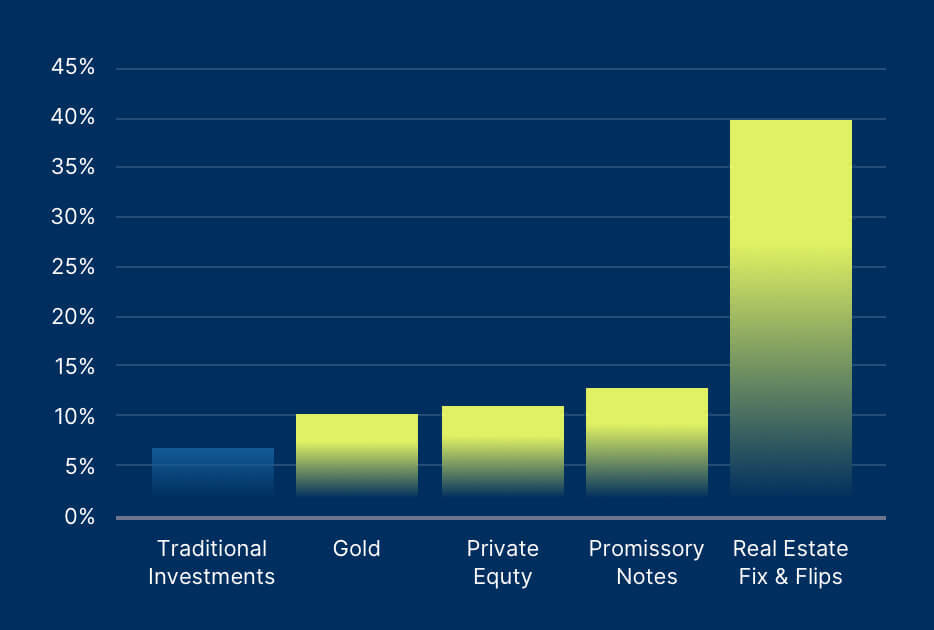

- Real Estate Fix & Flips 40.00%+

- Promissory Notes 12.00%

- Private Equity 10.50%

- Gold 10.20%

- Russell 2000 Index 7.29%

- S&P 500 5.37%

- DJIA 5.35%

At the intersection of opportunity and impact.

Changing your investment strategy to include alternative investments can dramatically expand your horizons, both from a return-on-investment and diversification perspective.

Is your investment strategy keeping up with the rapidly changing world?

Given the recent financial turbulence, your current investment strategy may not be as safeguarded as you’d like. A Self-Directed IRA empowers you to put your money to work in areas you know, understand, and are passionate about.

Let's talk about your financial future.

Schedule a one-on-one session with an expert alternative investment counselor. We're here to answer any questions, help guide you through the process, and provide more detailed information and education specific to your journey.

By entering your information and clicking Start a Conversation, you consent to receive reoccurring automated marketing emails about Equity Trust’s products and services. This consent is not required to obtain products and services. If you do not consent to receive emails from Equity Trust and seek information, contact us at 855-233-4382.