Self-Directed IRAs: Your Ticket to Investment Freedom

You have the power to take control of your financial future by investing in areas that you're excited and passionate about, knowing you have the support of the industry's leading self-directed IRA company in your corner.

Don't take our word for it, take theirs.

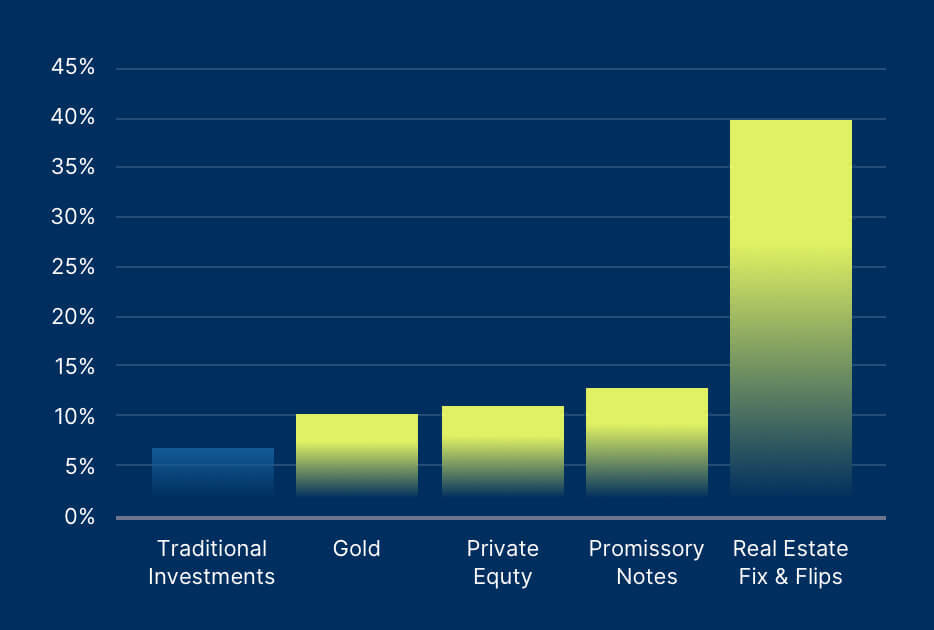

- Real Estate Fix & Flips 40%+

- Promissory Notes 12%

- Private Equity 10.5%

- Gold 10.2%

- Russell 2000 Index 7.29%

- S&P 500 5.37%

- DJIA 5.35%

At the intersection of opportunity and impact.

Changing your investment strategy to include alternative investments can dramatically expand your horizons, both from a return-on-investment and diversification perspective.

Is your investment strategy keeping up with the rapidly changing world?

Given the recent financial turbulence, your current investment strategy may not be as safeguarded as you’d like. A self-directed IRA empowers you to put your money to work in areas you know, understand, and are passionate about.

Second to none

Our unparalleled self-directed IRA expertise come with an unmatched record of service.

| Equity Trust | Most Custodians | |

|---|---|---|

| All-inclusive fee schedule |

|

|

| Free alternative asset buy/sell transactions |

|

|

| Free asset maintenance transactions (bill pays via ACH/check) |

|

|

| Access to alternative investment opportunities and providers in one place |

|

|

| Online account management tools |

|

|

| Easy-to-use online investment wizards |

|

|

| 50+ years of experience |

|

|

| 500+ employees |

|

|

Redefining retirement saving for 50+ years

Recognized as the industry leader and pioneer of self-directed IRAs, Equity Trust has unparalleled alternative asset expertise and an unmatched record of excellence. Named among the Top 7 IRA Accounts for 2022 by US News & World Report, we offer customized one-on-one sessions to discuss your interests and goals to help guide your success as you navigate your opportunities.

Investment Freedom

Investment Freedom

You can diversify into a range of options including real estate, private entities, digital assets, precious metals, and more, in addition to stocks, bonds, and mutual funds - all in one account.

Innovative Technology

Innovative Technology

Easily invest and manage your account on any device with our online account management system myEQUITY. Intuitive online wizards walk you through funding, purchases and sales, paying bills, distributions, and more.

You Direct, We Support

You Direct, We Support

You're in control, but you're not alone. Our knowledgeable associates provide personalized service, and we offer an abundance of learning opportunities.

Recognized Leader

Recognized Leader

Our size, expertise, and technology help us ensure that we're there when you need us most. Our 500+ associates work diligently to enhance your experience.

Access to Opportunities

Access to Opportunities

Don't have an investment in mind? Our WealthBridge investment portal and Investment District online marketplace enable you to find potential investment opportunities with the click of a button.

Exclusive Benefits

Exclusive Benefits

Each client receives access to exclusive opportunities not found with any other self-directed account custodian. You'll receive valuable, in-demand discounts and membership access.

Your financial future starts today

Open Your Equity Trust Account

One of our specialized counselors will walk you through the process, or you can do it online with myEQUITY. (10 minutes)

Fund Your New Tax-Advantaged Account

You can fund your account via rollover, transfer, or out-of-pocket contribution.

Select Your Investment

myEQUITY investment wizards walk you through the investment process online at your convenience. We have liaisons ready to help if you need it.

Let's talk about your financial future.

Schedule a one-on-one session with an expert alternative investment counselor. We're here to answer any questions, help guide you through the process, and provide more detailed information and education specific to your journey.

By entering your information and clicking Start a Conversation, you consent to receive reoccurring automated marketing emails about Equity Trust’s products and services. This consent is not required to obtain products and services. If you do not consent to receive emails from Equity Trust and seek information, contact us at 855-233-4382.