50% Off All

Education Courses

Happy Financial Literacy Month!

Enjoy half off all education courses

with code: LITERACY

Investor Insights Blog|5 Benefits Savvy Investors are Getting From Investing in Real Estate with Retirement Funds

Real Estate

Did you know it’s possible to purchase real estate with a retirement account and enjoy the same tax advantages as you would a stock or mutual fund?

Well, since IRAs were created in 1974 it has been…but why would you want to?

It might not seem worth it to learn about this powerful investing concept, especially if you already have a successful system in place and are profiting from your real estate investing.

But if you aren’t already one of the 5% of investors maximizing their profit potential on real estate, we’ll give you 5 reasons you should look into self-directed IRAs.

The only thing more powerful than making money on your money…is doing it without taxes

Eliminate capital gains and income taxes on real estate.

Like any investment in an IRA, profits and appreciation return back to the account tax-deferred or tax-free (depending on the type of account).

That means if you sell a property or receive rental income in your IRA, it returns directly back to your account and without owing any capital gains or income taxes.

Tap into your retirement funds for your real estate investments, without early withdrawal penalties.

If you had more capital…

Many investors don’t realize they’re sitting on a sizable fund for their real estate investing: their retirement accounts.

And contrary to popular belief, you don’t need to withdraw the funds from your account and take a penalty. Your IRA is what purchases and takes title to the property.

The only thing more powerful than making money on your money…is doing it without taxes.

How much do you pay in taxes on your real estate investments? On your income?

Imagine taking that 15, 20 or even 40% and keeping it to re-invest in the next project. How quickly would profits accumulate if you didn’t lose a portion to taxes?

Here’s a hypothetical scenario to demonstrate:

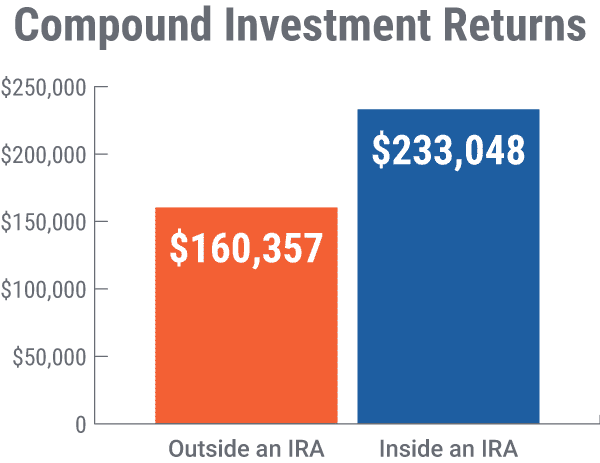

Let’s assume an investor invests $50,000 using a Roth IRA at the age of 40. Over the next 20 years, they receive an annual rate of return of 8% and have a marginal tax rate of 25%.

As you can see in the graph: the tax-advantaged, compounded returns in the Roth IRA resulted in over $72,000 more than if the same investments were conducted outside an IRA over the same 20 years.

Who’s responsible for your financial future? Your employer? The government? Or you?

As pensions disappear from the list of employee perks and with the projected reduction in Social Security benefits by 2034*, the responsibility of saving and investing for retirement increasingly falls on the individual.

But even with retirement accounts, there are varying levels of control when it comes to your investment options.

Most IRAs, 401(k)s and other retirement plans limit your investment options to stocks, bonds, and mutual funds.

Only certain custodians like Equity Trust support the ability to take control of your retirement with the freedom to invest in both the traditional markets and a wide variety of alternative assets – like real estate.

Create a nest egg of tax-advantaged passive income to fund your retirement and leave a legacy for your family.

You may have heard the phrase, “it’s not how much you make, it’s how much you keep.” With the ability to pass down your IRA to beneficiaries, a self-directed IRA is a powerful vehicle to potentially build and preserve your wealth.

Consider the example of holding rental properties in a Roth IRA.

Once you meet the eligibility requirements after age 59½, you could potentially live off the tax-free cash flow the properties produce and pass down a fully paid-off real estate portfolio to your children for them to enjoy tax-free as well.

You are leaving trustetc.com to enter the ETC Brokerage Services (Member FINRA/SIPC) website (etcbrokerage.com), the registered broker-dealer affiliate of Equity Trust Company. ETC Brokerage Services provides access to brokerage and investment products which ARE NOT FDIC insured. ETC Brokerage does not provide investment advice or recommendations as to any investment. All investments are selected and made solely by self-directed account owners.

Continue