What is a Roth IRA?

The Roth Individual Retirement Account (IRA) was created in 1997 as an alternative to the tax-deferred Traditional IRA, for investors who meet certain income requirements. Unlike a Traditional IRA, contributions to a Roth IRA are made after-tax and do not provide a tax deduction. However, investments and earnings within a Roth IRA are generally tax-free and distributions after age 59½ are also tax-free after the account has been established for at least five years.

With a self-directed Roth IRA at Equity Trust, you have the freedom to invest, tax-free, in real estate, notes, private equity, crypto, precious metals, and a wide variety of alternative assets, in addition to traditional assets like stocks, bonds, and mutual funds.

Videos

Benefits of a Roth IRA

Tax-free growth: Investment returns in a Roth IRA are tax-free and are not subject to capital gains tax or included in your taxable income for the year, allowing them to compound tax-free until withdrawn.

Tax-free withdrawals: Withdrawals from a Roth IRA after age 59½ are tax-free and are not included in your taxable income for the year, provided the account has been established for at least five years. This includes distributions of cash or assets.

Tax-free to beneficiaries: A Roth IRA, including exiting cash and assets, can be passed down with no estate or inheritance tax, allowing the beneficiary to continue investing with tax-free growth or begin taking tax-free withdrawals, even before 59½. Note: Funds must be withdrawn within 10 years of inheriting the account.

No required minimum distributions (RMDs) for account owner’s lifetime: Unlike the Traditional IRA and other tax-deferred accounts, Roth IRAs are not subject to RMDs, allowing you to keep assets in your portfolio, continue investing through retirement, and accumulate tax-free wealth to leave your beneficiary.

No age limits: You can contribute to your Roth IRA as long as you have earned income that qualifies. In addition, there is no minimum age requirement to open or contribute to a Roth IRA for those who qualify and have taxable income.*

Ability to withdraw contributions, any time, tax- and penalty-free: Since Roth IRA contributions are made after-tax, you are able to withdraw contributions from your Roth IRA at any time – even before age 59½ – and for any reason without tax or penalty. This applies only to out-of-pocket contributions and does not pertain to earnings or interest accrued.

Uses beyond retirement: It’s possible to withdraw Roth IRA funds tax- and penalty-free for approved uses in addition to retirement, including higher education, purchasing a first home, and some emergency expenses.

* Accounts opened for minors under age 18 who meet eligibility requirements require a parents/guardian to establish and manage the account.

Interested in alternative investments but don’t know where to start?

No problem. We make it easy to locate potential investments.

Available through our online account management system, myEQUITY, the WealthBridge portal provides a secure, direct connection to alternative asset investment platforms.

Discover WealthbridgeOur online marketplace introduces you to dozens of asset providers across various investment types including turnkey real estate, private equity, cryptocurrency, precious metals, and more.

Visit Investment DistrictRoth IRA Contribution Limits and Deadlines

The IRS sets limits for how much you can contribute to a Roth IRA each year. Income level determines whether you’re eligible to contribute to a Roth IRA.

If you’re 50 or older, you can take advantage of a “catch-up provision,” which means you can contribute an extra $1,000.

Roth IRA Contribution Limits and Deadline

| 2025 | 2024 | |

| Standard Contribution Limit | $7,000 | $7,000 |

| Catch-Up Contribution Limit (Age 50 and Older) | $8,000 | $8,000 |

| Contribution Deadline | 4/15/2026 | 4/15/2025 |

| Modified Adjusted Gross Income (MAGI) Limits – Single | $150,000 – $165,000 | $146,000 – $161,000 |

| Modified Adjusted Gross Income (MAGI) Limits – Married Filing Jointly | $236,000 – $246,000 | $230,000 – $240,000 |

| 2024 | |

| Standard Contribution Limit | $7,000 |

| Catch-Up Contribution Limit (Age 50 and Older) | $8,000 |

| Contribution Deadline | 4/15/2025 |

| Modified Adjusted Gross Income (MAGI) Limits – Single | $146,000 – $161,000 |

| Modified Adjusted Gross Income (MAGI) Limits – Married Filing Jointly | $230,000 – $240,000 |

Roth IRA Eligibility Requirements

Any individual with earned income is eligible to contribute to a Roth IRA.

What qualifies as earned income? Earned income includes wages, salaries commissions, tips, and other amounts received for completing work for an employer. For self-employed individuals, sole proprietors, and partners in a partnership, “earned income” refers to the net earnings from their business activities.

What does not qualify as earned income? Most rental income does not qualify as earned income for the purpose of contributing to a Roth IRA, along with passive income, like interest or dividends.

Roth IRA Account Rules

Contribution Limits: The IRS sets annual limits on how much you can contribute to a Roth IRA, which may change each year based on inflation.

Contributions and Tax–Free Growth: Contributions to a Roth IRA are made with after-tax dollars. This means that the money you contribute has already been taxed, allowing your investments to grow tax-free. Using after-tax dollars ensures that your contributions won’t be taxed when withdrawn, providing a key advantage for long-term savings.

No Required Minimum Distributions (RMDs): Unlike Traditional IRAs, Roth IRAs do not have required minimum distributions during the account owner’s lifetime. This allows your investments to grow tax-free for a longer period.

Withdrawal Rules: You can withdraw earnings tax-free from a Roth IRA after age 59½ and if the account has been open for at least five years.

Early Withdrawal Penalties: Contributions to a Roth IRA can be withdrawn at any time without penalties or taxes. However, withdrawing earnings before age 59½ and before the account has been open for at least five years generally results in taxes and a 10-percent penalty, with exceptions for specific circumstances like buying a first home or paying for qualified education expenses.

Traditional vs. Roth IRA

Contributions to a Roth IRA are made after tax; as a result, withdrawals are tax-free. Any investment earnings (such as interest, dividends, or capital gains) can grow tax-free within the account.

Here’s a summary of the difference between Roth IRAs and Traditional IRAs, including tax treatment:

| Traditional IRA | Roth IRA | |

| Tax Advantages | Account balances compound tax-deferred until funds are withdrawn | Account balances compound tax-deferred. BUT funds that are withdrawn are tax-free if account is five years old and account owner is over 59 1/2 |

| Eligibility | Individuals must have earned income* | Individuals must have earned income* and modified adjusted gross income less than current limits (see www.irs.gov for details) |

| Tax Deductions on Contributions | Yes | No |

| Penalties for Early Withdrawal | 10% penalty for withdrawals before age 59 1/2 | 10% penalty for withdrawals before age 59 1/2 and five year seasoning period (Note: Roth contributions can be taken out at any time without penalty) |

| Exceptions for 10% Penalty | Yes | Yes |

| Cut-off Age for Contributions | No limit | No limit |

| Required Distributions | Yes. You must take your first required minimum distribution by April 1 of the year after you turn 72 (70 1/2 if you reached 70 1/2 by January 1, 2020) | None |

| Traditional IRA | |

| Tax Advantages | Account balances compound tax-deferred until funds are withdrawn |

| Eligibility | Individuals must have earned income* |

| Tax Deductions on Contributions | Yes |

| Penalties for Early Withdrawal | 10% penalty for withdrawals before age 59 1/2 |

| Exceptions for 10% Penalty | Yes |

| Cut-off Age for Contributions | No limit |

| Required Distributions | Yes. You must take your first required minimum distribution by April 1 of the year after you turn 72 (70 1/2 if you reached 70 1/2 by January 1, 2020) |

* Earned income is defined as the salary or wages you receive as an employee. If you’re self-employed, earned income is your net income for personal services performed. Passive income such as interest, dividends, and most rental income are not considered compensation for the purpose of funding an IRA. Consult a financial professional to determine your earned income.

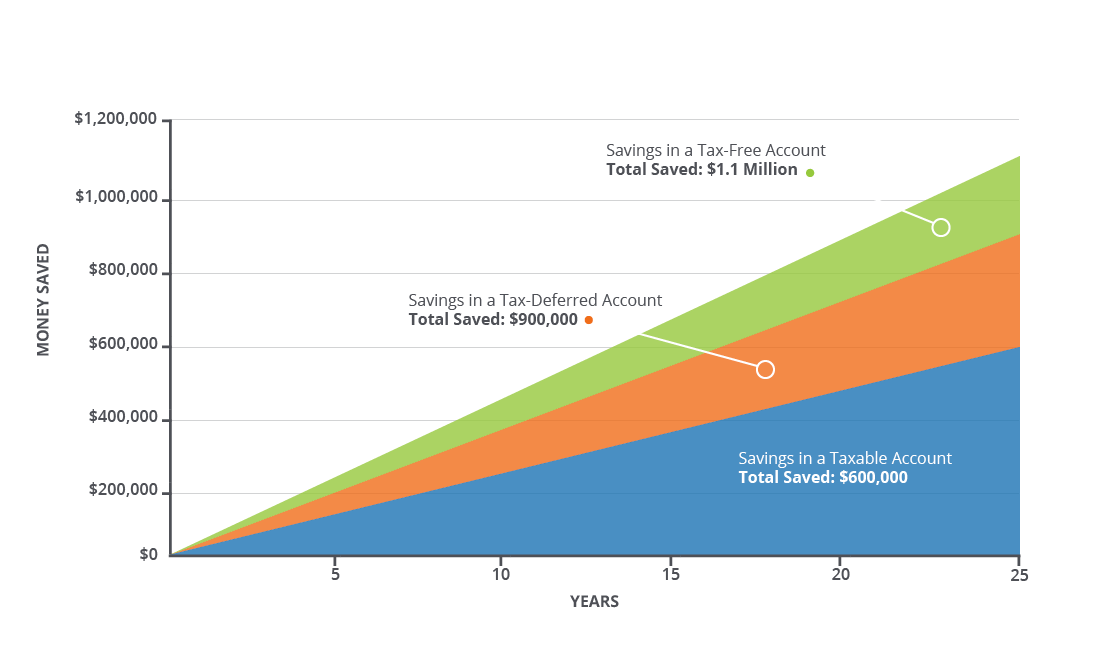

Taxable Account, Traditional IRA, and Roth IRA: Impact of Tax Savings Over Time

How much of your earnings could you keep by saving in a tax-advantaged account like a Roth IRA or Traditional IRA rather than a taxable account? In this hypothetical example, the same amount of money is contributed to a taxable account and Traditional IRA, with an 8-percent return over 25 years.

Getting Started with a Roth IRA

Here are the three steps to getting started with an Equity Trust self-directed Roth IRA:

Open your Equity Trust Roth IRA

One of our specialized counselors will walk you through the process, or you can do it online with myEQUITY.

Fund your new tax-advantaged account

You can fund your account via rollover, transfer, or out-of-pocket contribution.

Select your investment and direct Equity Trust to fund it

myEQUITY investment wizards walk you through the investment process online at your convenience. Our liaisons are ready to help if you need it.

Roth IRA FAQs

What is difference between a Roth IRA and a Traditional IRA?

The key difference between a Roth IRA and a Traditional IRA is how they are taxed. Contributions to a Traditional IRA are made with pre-tax dollars, which can lower your taxable income in the year you contribute, but withdrawals in retirement are taxed. Conversely, contributions to a Roth IRA are made with after-tax dollars, so they don’t provide an immediate tax break, but qualified withdrawals, including earnings, are tax-free.

Do Roth IRAs have required minimum distributions?

The required minimum distribution, or RMD, is the minimum amount required that you must take as a distribution from a retirement account each year. Roth IRAs do not require these distributions for original account owners, allowing long-term wealth growth in the account.

Can you have a Roth IRA and a 401(k)?

Yes, it is possible and common to have both a 401(k) and a separate retirement account like a Roth IRA. A 401(k) is an employer-sponsored retirement plan typically funded with pre-tax dollars through employer contributions and payroll deductions, whereas a Roth IRA is a retirement savings account, funded with after-tax dollars, that an individual opens independently. Having both accounts allows an individual to maximize their retirement savings and take advantage of the unique benefits each offers.

What is a backdoor Roth IRA?

A backdoor Roth IRA is an approach that allows those not able to contribute to a Roth IRA. If you don’t meet IRS guidelines to contribute to a Roth IRA, a backdoor Roth IRA occurs when you open and contribute to a Traditional IRA and then convert to a Roth IRA. However, there are guidelines to keep in mind before making this decision like the Pro-Rata Rule in relation to contributions in a Traditional IRA. Read more about the backdoor Roth IRA.

Is a Roth IRA tax free?

While no retirement account is 100% tax-free, a Roth IRA offers certain advantages with tax-free growth on your investments. Contributions to a Roth are after-tax, meaning you pay taxes on the money prior to the contribution. Once the funds are in the account, the money grows tax-free, meaning any growth or earnings you make is not taxed. Distributions can also be withdrawn without being taxed.

Do you pay capital gains on a Roth IRA?

As mentioned above, because the funds you’ve invested are after-tax dollars, you have already paid tax on the money. As a result, the investments within your Roth IRA grow tax-free. When you sell investments within the account, any gains you make are not subject to capital gains tax.

Self-Directed Roth IRA FAQs

What is a self-directed Roth IRA?

A self-directed Roth IRA is no different than a conventional Roth IRA. They are subject to all rules and regulations per IRS guidelines. Self-directed refers to the type of investments available to be held in the account. A self-directed Roth IRA could hold stocks, bonds, and mutual funds along with real estate, cryptocurrency, private equity, and other alternative investment options.

Where can I open a self-directed Roth IRA?

To open a self-directed Roth IRA, you need to choose a custodian, like Equity Trust, which is a financial institution that is qualified to handle this type of account. When choosing a self-directed IRA custodian, it’s important to consider their knowledge and experience within the industry. Major financial institutions such as Fidelity, Vanguard, and Merrill Lynch do not offer self-directed IRAs, so it’s essential to select a custodian that caters specifically to these types of accounts for the flexibility and support you need.

Can I trade cryptocurrency in a self-directed Roth IRA?

Yes, you can trade cryptocurrency in a self-directed Roth IRA. Unlike traditional retirement accounts, which typically limit investments to stocks, bonds, and mutual funds, a self-directed account allows for a broader range of investments, including cryptocurrencies. This flexibility lets you diversify your retirement portfolio with digital assets.

To do so, you need to open a self-directed Roth IRA with a custodian like Equity Trust that supports cryptocurrency investments. Once set up, you can buy, sell, and trade various cryptocurrencies within your account, enjoying the tax-free growth and withdrawals that Roth IRAs offer.