- Who We Serve

- What We Offer

- Equity Universal IRATM

- Self-Directed IRA

- Real Estate Checkbook

IRA LLC - 1031 Exchange

- Equity Solo 401(k)

- 990-T Tax Preparation

- Self-Clearing Retirement

Services - Wealthbridge Investment

Portal - Investment District

Marketplace Real Estate Investing Hub

Browse services, tools & education in one place.Have Questions?

Schedule a call with an IRA Counselor.

- Accounts

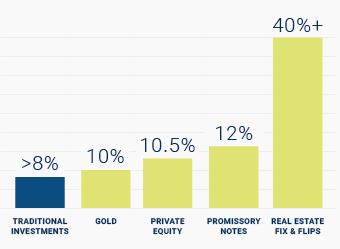

- Investment Types

- Resources

- About Us