What is a Health Savings Account (HSA)?

A Health Savings Account, or HSA, is a type of savings account that allows you to save pre-tax dollars to use for qualified medical expenses. These funds can be invested and grow, while remaining tax-free in the account. Once removed, funds won’t be taxed if the expenses qualify.

With an HSA, you can reduce out-of-pocket health costs by having money already saved to pay for current and future expenses. These expenses can range from ambulance rides to dental or eye exams to long-term care.

At Equity Trust, you can self-direct your HSA to invest in a wide range of non-traditional assets, including alternative investments like real estate, private equity, and more.

Videos

Benefits of an HSA

Lower premium costs: One of the key advantages of an HSA is that it is typically paired with a high-deductible health plan (HDHP), which generally comes with lower monthly premium costs. This means you can save money on your health insurance premiums while still having coverage for major medical expenses.

Tax deductible contributions: Contributions to your HSA are tax-deductible, meaning you can reduce your taxable income by the amount you contribute, whether you contribute through payroll deductions or on your own. This immediate tax saving is one of the most attractive benefits of an HSA.

Tax-free withdrawals: When you withdraw funds for qualified medical expenses, these withdrawals are tax-free and are not included as taxable income. This provides a powerful way to manage healthcare costs efficiently.

No penalties after age 65: Once you reach age 65, you can withdraw funds from your HSA for any purpose without facing a penalty. While non-medical withdrawals will be subject to regular income tax, this flexibility allows you to use your HSA funds in retirement for various expenses, offering an additional layer of financial security.

Interested in alternative investments but don’t know where to start?

No problem. We make it easy to locate potential investments.

Available through our online account management system, myEQUITY, the WealthBridge portal provides a secure, direct connection to alternative asset investment platforms.

Discover WealthbridgeOur online marketplace introduces you to dozens of asset providers across various investment types including turnkey real estate, private equity, cryptocurrency, precious metals, and more.

Visit Investment DistrictContribution Limits for an HSA

The IRS sets contribution limits for an HSA each year for both individual and family plans. See the current year’s contribution limits.

If you are over age 55 and under 65, you can take advantage of “catch-up contributions,” which means you can contribute an extra $1,000.

HSA Contribution Limits, Eligibility Requirements, and Contribution Deadlines

| Individual | Family | |||

| 2025 | 2024 | 2025 | 2024 | |

| Standard Limit (under age 55) |

$4,300 | $4,150 | $8,550 | $8,300 |

| Catch-up Limit (Age 55-65, 65 and older if you qualify) |

$5,300 | $5,150 | $9,550 | $9,300 |

| Minimum Deductible: | $1,650 | $1,600 | $3,300 | $3,200 |

| Annual Out-of-Pocket Expense Limit | $8,300 | $8,050 | $16,600 | $16,100 |

| 2025 Contribution Deadline | 4/15/2026 | |||

| 2024 Contribution Deadline | 4/15/2025 | |||

| Eligibility | Must be enrolled in a high-deductible health plan (HDHP) | |||

HSA Contribution Limits, Eligibility Requirements, and Contribution Deadlines

| Individual | ||

| 2025 | 2024 | |

| Standard Limit (under age 55) |

$4,300 | $4,150 |

| Catch-up Limit (Age 55-65, 65 and older if you qualify) |

$5,300 | $5,150 |

| Minimum Deductible: | $1,650 | $1,600 |

| Annual Out-of-Pocket Expense Limit | $8,300 | $8,050 |

| 2025 Contribution Deadline | 4/15/2026 | |

| 2024 Contribution Deadline | 4/15/2025 | |

| Eligibility | Must be enrolled in a high-deductible health plan (HDHP) | |

HSA Eligibility Requirements

To establish an HSA, you must be enrolled in a high-deductible health plan (HDHP). An HDHP can offer either self-only or family coverage. You cannot be enrolled in any other type of health insurance coverage unless such coverage is considered disregarded coverage.

Disregarded coverage includes insurance related to accidents, disability, vision, dental care, or long-term. This also includes insurance providing coverage regarding a special disease or illness or insurance paying a fixed amount per day for hospitalization coverage.

You are not eligible for an HSA if you:

- Are enrolled in Medicare part D or any other Medicare benefit program

- Can be claimed as a dependent on someone else’s tax return

HSA Rules

Contribution Limits: The IRS sets annual limits on how much you can contribute to an HSA, which may change annually according to inflation.

Eligibility Requirements: To be eligible to contribute to an HSA, you must be enrolled in a qualified HDHP. See above for more details.

Qualified Expenses: HSA funds must be used for qualified medical expenses to maintain their tax-free status. These expenses include a wide range of healthcare costs, such as doctor visits, prescription medications, dental and vision care, and even some over-the-counter medications. Qualified expenses can be incurred by the account holder, and their spouse or dependents if enrolled in family coverage. The IRS provides a comprehensive list of what qualifies as a medical expense.

Penalties for Non-Qualified Expenses: If HSA funds are used for non-qualified expenses before the account holder turns 65, the amount withdrawn will be subject to income tax and a 20% penalty. After age 65, funds can be withdrawn for non-medical expenses without the penalty, though they will still be subject to income tax. This rule allows for more flexibility in retirement while still encouraging the use of HSA funds for healthcare costs.

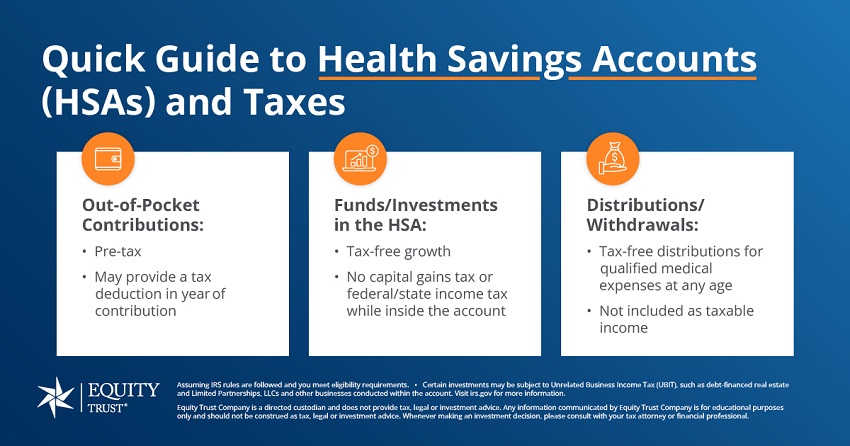

HSA and Taxes

Contributions to an HSA are made with pre-tax income, offering immediate tax savings. They are also tax-deductible, meaning you can reduce your taxable income by the amount you contribute, even if you don’t itemize your deductions.

The funds in your HSA can then grow tax-free through potential earnings from investments like interest, dividends, or capital gains. When you withdraw money to pay for qualified medical expenses, those withdrawals are tax-free as well.

This triple tax advantage makes HSAs a powerful tool for managing healthcare costs and saving for the future.

HSA vs. FSA: A Comparison

When it comes to saving for healthcare expenses, two popular account options are an HSA and a Flexible Spending Account (FSA). Each offers distinct advantages and can be an important part of managing your healthcare costs effectively.

Here’s a chart that outlines the key differences between an HSA and an FSA, helping you decide which option best suits your healthcare savings needs.

| HSA | FSA | |

| Tax Advantages | Tax-free growth and withdrawals for qualified expenses | Pre-tax contributions and fax-free withdrawals for qualified expenses |

| Eligibility | Must be enrolled in a high-deductible health plan (HDHP) | Offered through an employer; no specific health plan required |

| Contribution Limits | $4,150 for individuals and $8,300 for families | $3,200 for healthcare expenses |

| Rollover/Carryover Funds | Unused funds roll over year to year; no expiration | Use-it-or-lose-it policy; some plans allow a $640 rollover |

| Portability | Account is owned by the individual and remains with them if they change jobs or retire | Account is owned by the employer; funds are typically forfeited if employment ends |

| Qualified Expenses | Can be used for a wide range of medical expenses, including deductibles, copayments, prescriptions, and some over-the-counter medications | Covers similar medical expenses as an HSA but is less flexible with over-the-counter items |

| Investment Options | Various assets, such as stocks, mutual funds, and even alternative investments such as real estate, private equity, and more | No investment options; funds remain as cash |

| Withdrawals | Non-qualified withdrawals subject to income tax and a 20% penalty if taken before age 65 | Withdrawals for non-qualified expenses not permitted; funds must be used for eligible expenses |

| HSA | |

| Tax Advantages | Tax-free growth and withdrawals for qualified expenses |

| Eligibility | Must be enrolled in a high-deductible health plan (HDHP) |

| Contribution Limits | $4,150 for individuals and $8,300 for families |

| Rollover / Carryover Funds | Unused funds roll over year to year; no expiration |

| Portability | Account is owned by the individual and remains with them if they change jobs or retire |

| Qualified Expenses | Can be used for a wide range of medical expenses, including deductibles, copayments, prescriptions, and some over-the-counter medications |

| Investment Options | Various assets, such as stocks, mutual funds, and even alternative investments such as real estate, private equity, and more |

| Withdrawals | Non-qualified withdrawals subject to income tax and a 20% penalty if taken before age 65 |

Getting Started with an HSA

Here are the three steps to getting started with an Equity Trust self-directed HSA:

Open your Equity Trust HSA

One of our specialized IRA Counselors can assist you, or you can do it online through our account management system myEQUITY. *You must be enrolled in a high-deductible health plan to establish an HSA.

Fund your new tax-advantaged account

There are three ways to fund your account: rollover, transfer, or out-of-pocket contribution.

Find your investment and direct Equity Trust to send funds

myEQUITY investment wizards can walk you through submitting your investment online. Our liaisons are here to assist you if you need help.

FAQs

How do you use HSA money?

HSA funds may be used to pay for qualified medical expenses, such as doctor visits, prescription medications, dental and vision care, and certain over-the-counter drugs. You can take tax-free distributions from your HSA to reimburse yourself for qualified expenses paid out-of-pocket.

What is the difference between an FSA and an HSA?

An HSA is a savings account that you can contribute to if you have a high-deductible health plan (HDHP). The funds roll over year to year, and the account is owned by you, even if you change jobs. An FSA (Flexible Spending Account) is typically owned by your employer, and the funds must be used within the plan year, or you lose them, although some plans offer a small rollover or grace period.

Can I withdraw money from my HSA?

Yes, you can withdraw money from your HSA at any time. If the funds are used for qualified medical expenses, the withdrawal is tax-free. However, if you withdraw funds for non-qualified expenses before age 65, the amount will be subject to income tax and a 20% penalty. After age 65, non-qualified withdrawals are only subject to income tax, without the penalty.

Do employer contributions affect HSA limit?

Yes, employer contributions to your HSA count toward the annual contribution limit set by the IRS. For 2024, the contribution limits are $4,150 for individuals and $8,300 for families. Any contributions made by your employer are included in these totals.

Do HSA funds expire?

No, HSA funds do not expire. The money in your HSA rolls over year to year, and there is no deadline for using the funds. You can continue to accumulate and use the funds for qualified medical expenses throughout your life.

Can an HSA be used for dental or eye exams?

Yes, HSA funds can be used to pay for qualified dental and vision expenses, including routine exams, treatments, glasses, and contact lenses. These expenses qualify for tax-free withdrawals from your HSA.

Can I use my HSA for a gym membership?

Generally, gym memberships do not qualify as a medical expense under HSA rules, so you cannot use your HSA funds to pay for a gym membership. However, there may be exceptions if a doctor prescribes exercise as a treatment for a specific medical condition.

Can I use my HSA for my spouse?

Yes, you can use your HSA funds to pay for qualified medical expenses for your spouse, even if they are not covered under your high-deductible health plan. This includes expenses such as doctor visits, medications, and other eligible healthcare costs.