50% Off All

Education Courses

Happy Financial Literacy Month!

Enjoy half off all education courses

with code: LITERACY

Investor Insights Blog|How to Keep More of What You Make: The Difference Between Saving in Taxable, Tax-Deferred, and Tax-Free Accounts

Tax-Advantaged Accounts

When it comes to retirement accounts, you may be aware that there are tax-deferred accounts and tax-free accounts. But do you understand what the differences are?

Here’s a commonly used analogy that could help you understand this:

This describes what you do with tax-free accounts, such as the Roth IRA, the Coverdell Education Savings Account (CESA), and the Health Saving Account (HSA).

With the Roth IRA, you’re paying taxes on the seed but not getting a tax deduction when you contribute to the account. (However, with the CESA and HSA, you receive a tax deduction when you contribute).

Going forward, you pay no taxes on the proverbial crop when you take distributions from the account. This is what attracts many investors to the Roth IRA.

Client example: Kay from California was making over $64,000 in net tax-free profit on her investments every single year. In retirement, she has $64,000 tax-free coming in every single year that never hits her 1040 tax form as ordinary income because it’s in her Roth IRA. She got the taxes out of the way on the “seed” so she doesn’t have to pay them on the “crop.”

With tax-deferred accounts, you don’t pay taxes on the seed. In many instances, you get a tax deduction for the money going into the account.

Tax-deferred accounts include the Traditional IRA, and small-business accounts SEP IRA, SIMPLE IRA, and Solo 401(k).

When you contribute, you receive a tax deduction, and your account grows tax-deferred. As you buy and sell real estate, stocks, mutual funds, or any other investment, you don’t pay taxes in each incremental year.

Eventually, when you start withdrawing money (for Traditional IRAs, the qualified age is 59 1/2), you’ll have to pay taxes on that money.

For investors who need tax deductions now, tax-deferred accounts may be the better option.

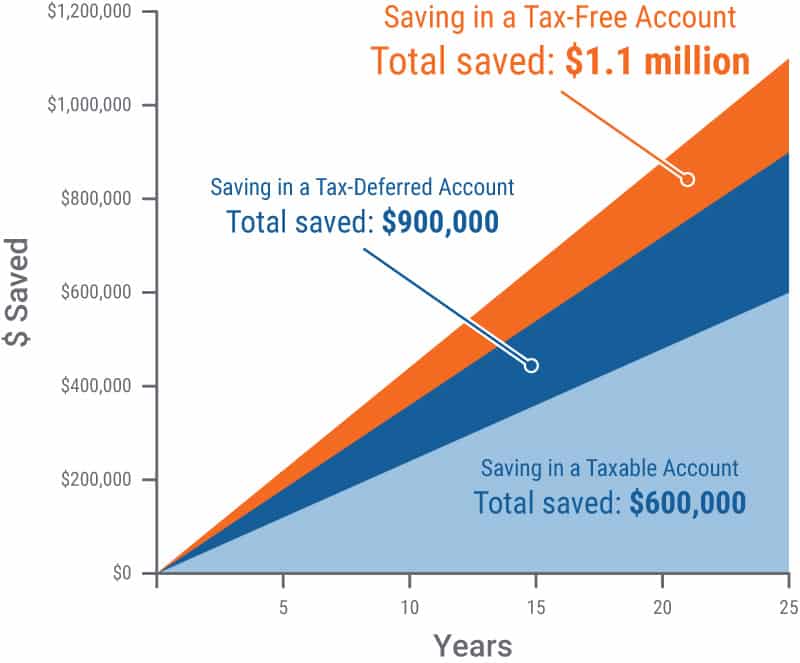

Contribution Amount: $6,000 per year ($16.43 per day) for 25 Years

Hypothetical return: 12 percent

Assuming a 30-percent tax rate during the years you make contributions and a 20-percent tax rate during distribution years.

Savings or Checking Account

Total saved: $600,000

Traditional SEP, Simple, Solo, 401(k)

Total saved: $900,000 ($300,000 more than having your money in a taxable account)

Roth IRA, CESA, HSA

Total saved: $1.1 million (well over $100,000 more than in a tax-deferred account)

Compared to a taxable account, that’s $500,000 in taxes saved over a 25-year period.

Get more information: Compare taxes in each account.

You are leaving trustetc.com to enter the ETC Brokerage Services (Member FINRA/SIPC) website (etcbrokerage.com), the registered broker-dealer affiliate of Equity Trust Company. ETC Brokerage Services provides access to brokerage and investment products which ARE NOT FDIC insured. ETC Brokerage does not provide investment advice or recommendations as to any investment. All investments are selected and made solely by self-directed account owners.

Continue