50% Off All

Education Courses

Happy Financial Literacy Month!

Enjoy half off all education courses

with code: LITERACY

Investor Insights Blog|Top States With Out-of-State Real Estate Investments in Equity Trust IRAs

Real Estate

A recent Wall Street Journal article cast a spotlight on self-directed real estate investing and shared that an increasing number of investors are investing in properties in Cleveland due to favorable pricing. Investors are flocking to Ohio from as far away as California to take advantage of the housing prices and resale potential.

As we’ve highlighted, some Equity Trust self-directed investors are interested in real estate as an alternative investment but are priced out of their local market or have knowledge of other markets in the country.

For these reasons and more, investors have found benefits in investing in a rental property or fix-and-flip outside of their home state.

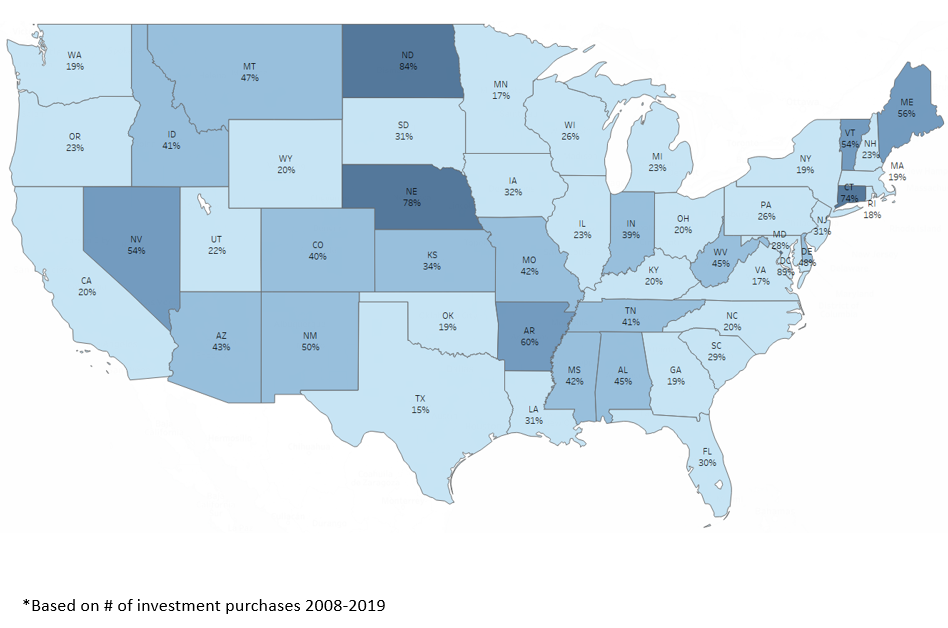

Which states receive the highest proportion of out-of-state real estate investing activity? We looked at clients’ real estate purchases in their self-directed IRAs to reveal where the percentage of non-resident purchases was the highest.

1. Washington, D.C.

2. North Dakota

3. Nebraska

4. Connecticut

5. Arkansas

6. Maine

7. Nevada (tie)

7. Vermont (tie)

9. New Mexico

10. Delaware

Curious to see how other states rank? Here is the entire map showing the percentage of each state’s Equity Trust IRA real estate purchases that were made by out-of-state investors.

Interested in more real estate investor data, including the states with the highest and lowest purchase prices for self-directed investment property? Download our latest Self-Directed Real Estate Market Report now.

If I invested in a rental property with my IRA, how does the rental income get into my account?

Can my IRA purchase real estate that I currently own?

You are leaving trustetc.com to enter the ETC Brokerage Services (Member FINRA/SIPC) website (etcbrokerage.com), the registered broker-dealer affiliate of Equity Trust Company. ETC Brokerage Services provides access to brokerage and investment products which ARE NOT FDIC insured. ETC Brokerage does not provide investment advice or recommendations as to any investment. All investments are selected and made solely by self-directed account owners.

Continue