Equity Trust’s Specialized Team is Here to Assist You

Use the information on this page to better understand UBTI and its implications. If you need assistance preparing your 990-T, let our specialists at Equity Administrative Services (Equity) handle it for you. If you need more time or help making a final determination, we can file an extension for your IRA, which will not affect your personal tax filing deadline.

How Would You

Like to Proceed?

Please respond by April 1, 2025 to provide ample time to meet the IRS filing deadline of April 15, 2025 and avoid a $75 late documentation fee.

Watch to learn more about UBIT and how Equity Trust can help with reporting:

Resources

Use the below resources to better understand the nature of UBTI.

INVESTMENTS THAT COMMONLY TRIGGER UBTI

- Investments into leveraged funds and/or partnerships

- Investments into operating businesses structured as LLCs

- Debt-financed property

Scenario 1: Leveraged Funds

An IRA is a limited partner in an investment fund. The fund’s strategy uses leverage in addition equity provided by its investor base.

Since the fund contains leveraging, UBTI may be reported on the annual K-1. If the UBTI reported exceeds $1,000, IRA partners in this scenario would need to file a 990-T.

For more information about this scenario, including where to look on a K-1 please refer to the Frequently Asked Questions below, or reach out to our team of specialists who are ready to assist by emailing [email protected].

Scenario 2: Operating Business

If your IRA is invested in a passthrough entity, such as an LLC or LP, and that entity operates a business, it may generate UBTI. An operating business is defined as a trade or business activity that is regularly carried on.

For example, if your IRA owns a restaurant, which operates as a regular business, the income generated from that restaurant would be considered UBTI for the IRA, and a 990-T would need to be prepared if the UBTI exceeds $1,000 for the tax year.

HOW CAN I DETERMINE IF MY INVESTMENT GENERATED UBTI?

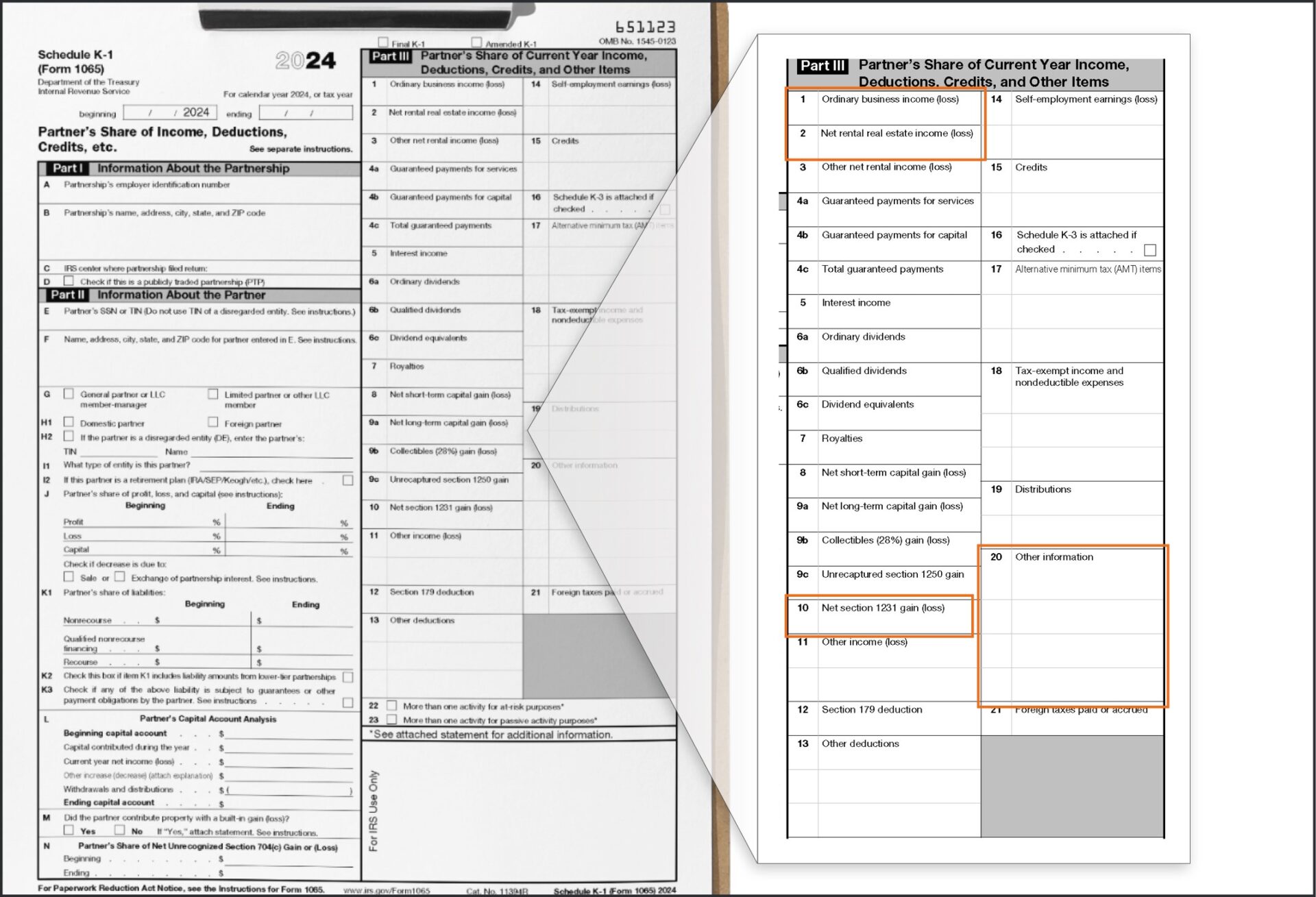

While your tax advisor will be able to tell you for certain, indications that a 990-T must be prepared are commonly identified on your annual K-1:

- If Box 20 contains code “V” UBTI was generated. If the amount of UBTI generated across the IRA exceeds $1,000 you must file a 990-T.

- If Box 20 does not contain a “V” but you show amounts, especially large amounts, in Box 1, Box 2, or in Box 10, it’s worth asking the K-1 issuer if any UBTI was generated in those figures.

- You can also check the K-1s supporting documentation to identify any references to Unrelated Business Taxable Income.

If you do not have your K-1 yet, let Equity help you file an extension for your IRA to provide more time to make your determination. Submit your request for an extension above.

How Equity Can Help

Equity’s specialized team is here for you! We offer the following services:

- Efficient preparation of 990-T forms

- Filing extensions for IRAs to provide additional time

- Assistance with determining whether UBTI was reported

To engage with our specialists, select how you would like to proceed above or send us a message at [email protected] and we will be in touch.

Frequently Asked Questions

What is Unrelated Business Income Tax (UBIT)?

UBIT, or Unrelated Business Income Tax, is levied on tax-exempt organizations for income generated from activities unrelated to their tax-exempt purpose. In the case of IRAs, this tax may apply when investing in an operating trade or business structured as a passthrough entity such as an LLC or LP. This tax is meant to eliminate competitive advantages.

What is Unrelated Debt-Financed Income (UDFI)?

UDFI, or Unrelated Debt-Financed Income, is a tax that is applied to leveraged investments, particularly real estate. It taxes earnings attributable to the leveraged portion. UDFI can apply to both directly owned properties that contain a mortgage, and investments in funds or partnerships.

Are UDFI and UBIT the same?

Although they are related concepts, Unrelated Debt-Financed Income is the activity that would result in the income produced, Unrelated Business Taxable Income (UBTI).

How can I determine if UBIT or UDFI applies to my investment?

Indications that UBIT was reported, resulting in a need for a 990-T, can be identified by looking at your K-1 partnership return for your investment(s) :

- If Box 20 contains code “V”

- If the K-1 has no Box 20 “V” but has positive amounts in Box 1 and Box 2, and Box 10 shows liabilities, it’s best to consult with the investment issuer as UBIT may have been reported

What is defined as an operating business?

For purposes of UBIT, an operating business typically involves conducting active income-generating operations by offering goods or services and/or holding an inventory. Examples would include restaurants and stores.

If I owe tax, how is that paid?

The IRS requires that all UBIT/UDFI liability is to be paid from your IRA, not with personal funds. Contact us to learn how to submit a payment to the IRS from your Equity Trust account.

What are the key dates?

Investors must pay any tax liability or make prepayments by April 15, 2025 for the 2024 tax year. This liability is paid from the IRA. Investors have until October 15, 2025 to file their 990-T if they’ve filed an extension for their IRA.

Please keep in mind that the 990-T filing and extension process will not impact the timing of your personal tax return.

What are the current tax rates?

The IRS provides the tax rates in its 990T preparation publication.

What if I don’t have my K-1 yet?

It’s common for K-1s to reach investors close to the tax filing deadline, or even after. Many investors prepay any expected liability and file an extension to allow for more clarity. Filing an extension for your IRA will not impact the timing of your personal tax return.

Additional Links of Interest

You are leaving trustetc.com to enter the ETC Brokerage Services (Member FINRA/SIPC) website (etcbrokerage.com), the registered broker-dealer affiliate of Equity Trust Company. ETC Brokerage Services provides access to brokerage and investment products which ARE NOT FDIC insured. ETC Brokerage does not provide investment advice or recommendations as to any investment. All investments are selected and made solely by self-directed account owners.

Continue