50% Off All

Education Courses

Happy Financial Literacy Month!

Enjoy half off all education courses

with code: LITERACY

Investor Insights Blog|Mark’s Story Part III: Promissory Notes and What He Wishes He Knew Sooner

Real Life Examples

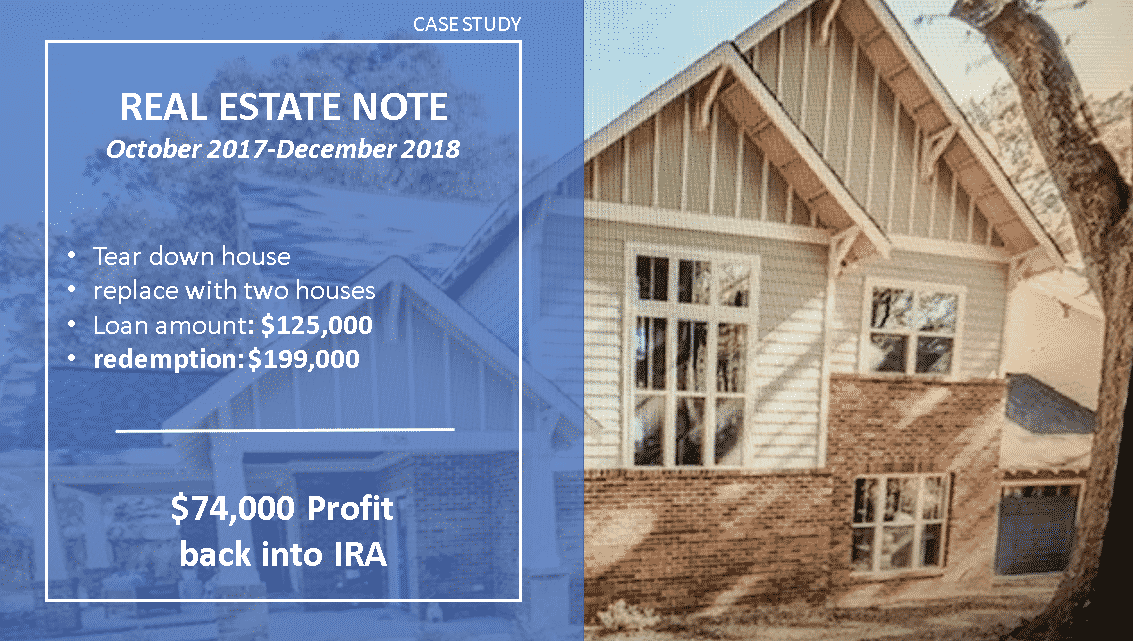

Equity Trust National Education Specialist John Bowens sat down with Mark from North Carolina to discuss how he successfully completed his first two investments resulting in $119,000 in tax-deferred profits.

In part three of the interview, Mark walks through his note investment, what the process was like for him, and what he wishes he knew sooner about this retirement saving strategy.

Haven’t read part one or part two yet? Read Part I of Mark’s Story and Part II of Mark’s Story

John: Let’s go ahead and jump into the next transaction. Now this is a little different because it’s a note. Now, in the first transaction, Mark’s IRA was holding a deed to the property.

But another way in which folks can invest with their self-directed IRA is to make loans secured by real estate, or potentially unsecured loans.

Now, again, it’s up to Mark or up to the account holder to do their own due diligence. But Mark, can you take use through the transaction?

Mark: The Realtor that got me involved with this was a friend of mine. And he knew I wanted to get involved with real estate also, and he asked me, what, what do you want to do?

Do you want to actually buy some rehab properties? Do you want to just rent? Or do you want to invest in notes or how do you want to do it? And I said, whatever makes more sense, I’m not sure.

So, having said that, about two months later, he came to me with this opportunity.

They needed somebody else to invest $100,000 and then invest another $25,000 in the holding, the interest payments, if you will, for the loan from the bank.

He got me involved with this and initially it was going to be a rehab of an existing house that was there. The property is located about two miles south of downtown Charlotte in a very desirable area. They are rehabbing houses in this area often.

Now the builder itself initially that was one of the partners, said, “The margins are kind of tight. I’m not sure whether it makes sense to rehab this.”

The realtor knew what the codes were in Charlotte and was able to actually turn this into two properties, rather than one property, because it was on a corner and have each property face each street so you could actually have two homes on one existing lot itself.

So ultimately, that’s what we did. It was a tear down and we put two $700,000 homes on this one lot versus one $700,000 property.

They used me for $100,000 in the carrying costs for the loan that they were taking out. And that was $25,000. Again, I was one of four partners.

Ultimately, what we ended up with was $75,000 apiece, or, you know, or in this particular case, $300,000 split between four. It was a great, great find.

Client story: Greg Explains Why He Loans Money with His Self-Directed IRA

John: Did you get a promissory note? Was that the actual financial instrument if you will, that your IRA received?

Mark: We had to do an unsecured note because they actually took out a loan and the loan wasn’t in my name. It could not be titled or anything in my name. And that’s why we did it that way.

We contacted my attorney and Equity Trust to work through how we could set this up to where it worked for all parties. And ultimately, that’s why we had to do an unsecured note.

John: There are secured notes and unsecured notes. In this case, Mark got all of his financial team members in place and made a loan to the builders LLC.

He was partnering with a few other individuals as well. And then ultimately upon the sale, the monies were returned split according to the agreements.

His IRA made a $74,000 interest, income profit, if you will, into the retirement plan. At closing, that money went back into the IRA.

What are your plans going forward? What types of transactions are you looking at?

Mark: Well, the last one that you just showed John, we closed on the property I believe on the 20th of December (2018), and we all went out to celebrate and have dinner.

Shortly there afterwards, two of the three other folks that was involved with this asked me to and I’ve invested in two additional properties with them.

Now this time, it’s not an unsecured note, it is secured through real estate. There’s two separate transactions. Both closed in the month of January. One of them for $135,000, and the other one for $150,000.

There’s a total of four homes being built from the ground up. They bought lots and now they’re building on those lots. They’re small luxury homes.

I’m going to be able to make 20 percent on our money. I don’t believe we can do that right now in the stock market.

Mark, Self-Directed Investor of the Year

John: How are you charging like a per annum interest rate, a flat interest rate, how do you carve up those loan agreements?

Mark: Both. The $150,000 one was done on a pure, guaranteed interest, guaranteeing 20 percent. So on $150,000, I’ll make $30,000 on that investment.

When they came to me, it was back when the stock market tanked and my wife said, “You’re buying more real estate?” I said, “Well, yes!”

I don’t believe we can do that right now in the stock market. So the first one is a 20 percent. The other one was sharing part of the profit, no less than 15 percent.

But it could actually be more than 20 percent. And on that one, the one for $135,000, I actually anticipate that and I would prefer to share in the profit. The reason is, they have more of an incentive.

“They,” meaning me as an investor to the builder has more of an incentive. When I actually share the profit rather than just getting paid a flat fee for my investment.

John: Okay, outstanding. And, again, I’ll echo, in particularly because Equity Trust takes our directed nature as a custodian very, very seriously in that, we want our clients to be reaching out to their members of their financial team.

I really admire Mark reaching out to the necessary professionals, and then coordinating with Equity Trust Company in terms of what you need for your custodial services.

And as always, prior performance is not predictive of future results.

But again, Mark, incredible, incredible story in the returns on investment that you’ve been able to achieve. And most importantly, as we talked about here, doing it in a tax-advantaged environment.

I was just running some compounding interest calculations earlier today for my team and showing, you know, over 15 years starting with $150,000, and making a consistent 18-percent return on investment year-over-year, compounded just once per year, and in a tax-exempt environment, one would have well over $1.5 million.

So, when you start to look at those returns, it’s quite incredible.

Anything else you can think of Mark?

Mark: I just wish that I would have known about this 10 years earlier than I do. But I’m glad I do it today.

If I invested in a rental property with my IRA, how does the rental income get into my account?

What investment options are possible with an Equity Trust account?

Am I restricted to only purchasing residential property with my IRA?

Case studies provided are for illustrative and educational purposes only. Past performance is not indicative of future results. Investing involves risk, including the possible loss of principal. Quotes and information included in the case studies and testimonials were provided by the investors and included with permission. Equity Trust Company does not independently verify all information provided by third parties.

You are leaving trustetc.com to enter the ETC Brokerage Services (Member FINRA/SIPC) website (etcbrokerage.com), the registered broker-dealer affiliate of Equity Trust Company. ETC Brokerage Services provides access to brokerage and investment products which ARE NOT FDIC insured. ETC Brokerage does not provide investment advice or recommendations as to any investment. All investments are selected and made solely by self-directed account owners.

Continue