50% Off All

Education Courses

Happy Financial Literacy Month!

Enjoy half off all education courses

with code: LITERACY

Investor Insights Blog|Public and Private Investments in One IRA: Is it Possible?

Self-Directed IRA Concepts

The last few decades have shown an increased interest in the private markets and alternative assets as investors seek higher returns and exposure to other avenues of diversification.

“Private markets have graduated from the fringes of the economy to the mainstream,” according to McKinsey & Company’s Global Private Markets Review 2019: Private Markets Come of Age. The report details how the net asset value of private equity has grown twice as fast as global public equities since 2002.

Despite the prevalence of private equity and hedge funds as the largest alternative asset classes to go mainstream, the world’s largest and oldest asset class – real estate – is increasingly seen as an investment vehicle beyond its traditional role as a personal residence.

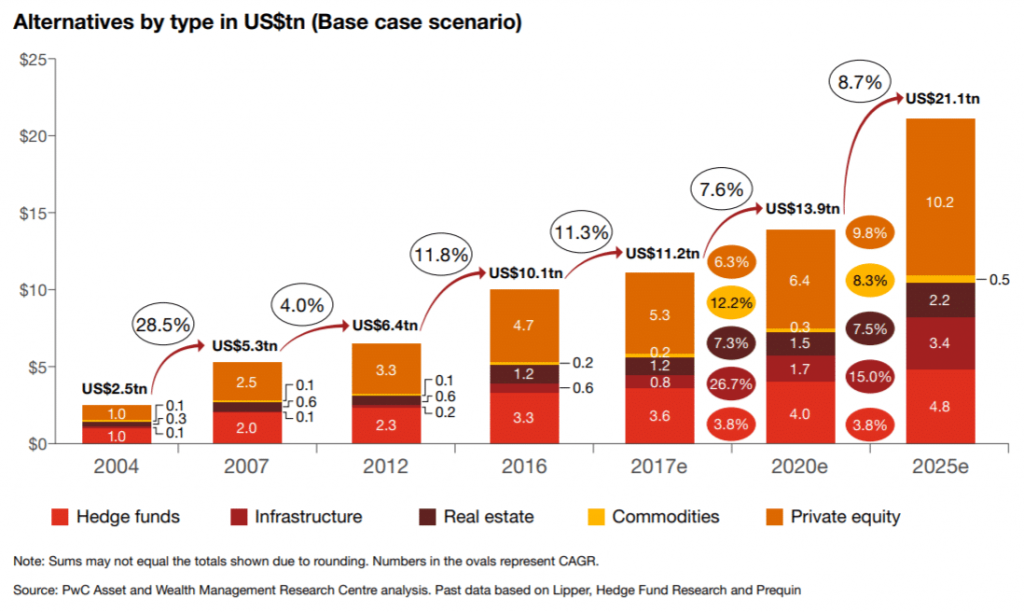

According to PricewaterhouseCoopers (PwC), real estate and infrastructure (real assets) project to be the fastest-expanding sector in the continued growth of alternative assets. In total, PwC estimates alternative assets under management will almost double from $11.2 trillion in 2017 to $21.1 trillion in 2025.

I became frustrated with my low yields on bonds in my IRA and decided to open a self-directed account with Equity Trust. I’d estimate I would have made possibly $10,000 in my old bond fund and instead created hundreds of thousands of dollars and had a great time learning the new market and controlling my financial wealth.

Self-Directed Investor Coby M., Indiana

Similar trends have played out in the IRA industry as well. Over the past decade, Equity Trust Company, a directed IRA custodian, has grown from holding $8 billion in assets under custody in 2010 to $28.7 billion in 2020.

While this growth is due to a variety of factors, including innovation and strategic acquisitions, the increasing demand for access to private market investments from retirement investors is a major contributor.

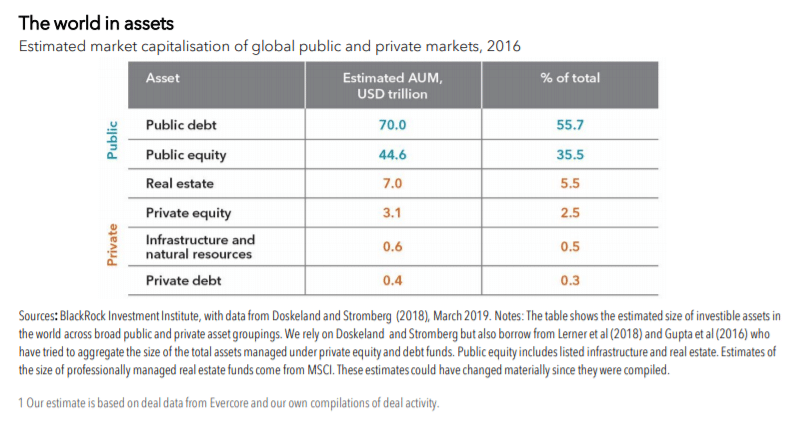

Despite the growing popularity, however, alternative asset classes are still a minor part of total investment allocations.

BlackRock Investment Institute estimated private markets make up about 9 percent of the market portfolio of global investible assets.

“[The] industry tends to sell and recommend assets that can be traded in public markets daily,” said John Nicola, chairman and chief executive officer of Nicola Wealth Management Ltd.

“Our philosophy is very simply this: In order to have a diversified portfolio, you should invest in assets that are representative of global wealth. Our view is that’s a fraction of global wealth, and private assets are a greater share of that wealth. Real estate, private equity, private debt, and mortgages are all part of the real-world assets.”

“I opened a self-directed IRA to remove my financial exposure to the stock market in my retirement days. Real estate investments provide me with stable rental income along with increased market value on my properties.”

– Fred B., Ohio

As Equity Trust Company CEO George Sullivan shared in a feature for Crain’s Cleveland Business Redefining Retirement series, “In today’s economy, diversifying is an increasingly wise choice: A sound investment strategy includes both public and private investments to optimize return on investment (ROI) and minimize the impact of market volatility.”

It’s about having the ability to hand-select the investments in your portfolio, in whatever way makes sense for you, without limitations.

This is a choice many retirement investors don’t have due to their custodian’s lack of capabilities.

According to the IRS, “IRA trustees are permitted to impose additional restrictions on investments. For example, because of administrative burdens, many IRA trustees do not permit IRA owners to invest IRA funds in real estate. IRA law does not prohibit investing in real estate, but trustees are not required to offer real estate as an option.”

Most retirement plan custodians do not permit investments in many alternative assets because of the aforementioned “administrative burdens.”

Of those that do, typically referred to as self-directed IRA custodians, many do not support a seamless solution to invest in traditional assets like stocks, bonds, and mutual funds because of their specialized focus on the alternative asset niche.

Despite specializing in alternative asset custody, Equity Trust Company has always maintained solutions for our clients to access the public markets since our start in 1974.

With the recently added online investing capability of our myEQUITY Mutual Fund Wizard, in addition to the expanded traditional investment possibilities offered by our affiliate ETC Brokerage Services, you don’t have to decide on one type of investment strategy.

Video: Investing in Mutual Funds through myEQUITY in a Self-Directed IRA

You have the freedom to diversify. You can construct your retirement portfolio however you see fit, all under the same company roof.

“As the inventory of homes for sale continues to decline, it’s harder and harder to find “deals”. The Equity Trust brokerage account is another way to invest and make money with my retirement account.

– Frank O., Texas

Whether you’re investing in an asset class you know well (like real estate), find a private market investment opportunity, want to add physical gold or other bullion, or simply seek diversification beyond the stock market, Equity Trust Company provides the flexibility to seamlessly move capital between public and private market investments.

This capability has served our clients well in volatile markets. For example, we saw an increase in private to public market volume of 221 percent from the end of February through March 2020 during the height of the COVID-19 pandemic, while trade volume at ETC Brokerage has more than tripled since February 2020 (as of June 11, 2020).

By providing a seamless way to invest and putting diversification in your hands, Equity Trust Company clients can customize and diversify their portfolios between public and private market investments.

Am I restricted to only purchasing residential property with my IRA?

What investments can I make using a self-directed IRA?

Equity Trust Company is a directed custodian and does not provide tax, legal, or investment advice. Any information communicated by Equity Trust Company is for educational purposes only, and should not be construed as tax, legal, or investment advice. Whenever making an investment decision, please consult with your tax attorney or financial professional.

Equity Trust Company evolved from a predecessor brokerage firm founded in 1974, to directed custodian today with over 45 years of experience.

Assets under custody as of 3/1/2020.

You are leaving trustetc.com to enter the ETC Brokerage Services (Member FINRA/SIPC) website (etcbrokerage.com), the registered broker-dealer affiliate of Equity Trust Company. ETC Brokerage Services provides access to brokerage and investment products which ARE NOT FDIC insured. ETC Brokerage does not provide investment advice or recommendations as to any investment. All investments are selected and made solely by self-directed account owners.

Continue