41K

Transactions

Through API Suite

$17T

Investment Potential

of Retirement Accounts1

EQUITYCONNECT

Streamline Investing with EquityConnect

It has never been easier to connect investors with alternative assets. EquityConnect enables you to easily establish and manage retirement and non-retirement accounts, all in one place.

This state-of-the-art, turnkey solution is designed for advisors or platforms interested in providing their clients with access to the world of alternative assets. EquityConnect includes a suite of customizable APIs and account management capabilities that simplifies investing.

EquityConnect allows you to:

- Expand entry into the multi-trillion-dollar IRA market by providing an easier way to invest

- Maintain and control your own client experience

- Choose the integration level that works best for your firm and clients

- Utilize immediately available APIs including Account Open, Transfer, and Purchase

- Accept IRA funds on your platform within days with non-API options such as co-branded website or dedicated link

- Remove duplicative efforts, saving you time

Equity Trust Offers Peace of Mind

As a regulated trust company, we adhere to the strictest standards to protect investors.

- Industry-leading cyber-security tools, practices, and technology

- Multi-factor authentication practices verify our clients’ identities

- Comprehensive business continuity plans

- Continuous employee education on ever-evolving cyber-security threats

- Regulated as a South Dakota trust company and compliant with all statutes and regulations mandated by the South Dakota Division of Banking

The Equity Trust Advantage

Equity Trust Company offers the total package of technology and support to help your business soar to new levels.

Exceptional Levels of Service

Our large, specialized teams support our technology to ensure timely and accurate transactions.

Education and Resources

Complimentary articles, guides, videos, and webinars leverage our 50+ years of experience and help educate your investors on the benefits of tax-advantaged IRA investing.

Key Account Designation

This designation provides a dedicated relationship manager and a streamlined, discounted fee schedule.

Suite of Workflow Reports

Including account opening, funding, holdings, disbursements, Required Minimum Distributions (RMDs), outstanding fees, and pending transfers are automatically pushed to your inbox for weekly, daily, or hourly updates.

Account Data Integration

Secure File Transfer Protocol (SFTP) connection provides the ability to receive Equity Trust client account data including purchases, redemptions, dividends, and money movements into your existing portfolio management system.

Established, Leading Custodian

Equity Trust Company has 50+ years of experience in the financial services industry and was named Best Overall Self-Directed IRA Company by Investopedia from 2020-2025.

Exceptional Levels of Service

Education and Resources

Key Account Designation

Suite of Workflow Reports

Account Data Integration

Established, Leading Custodian

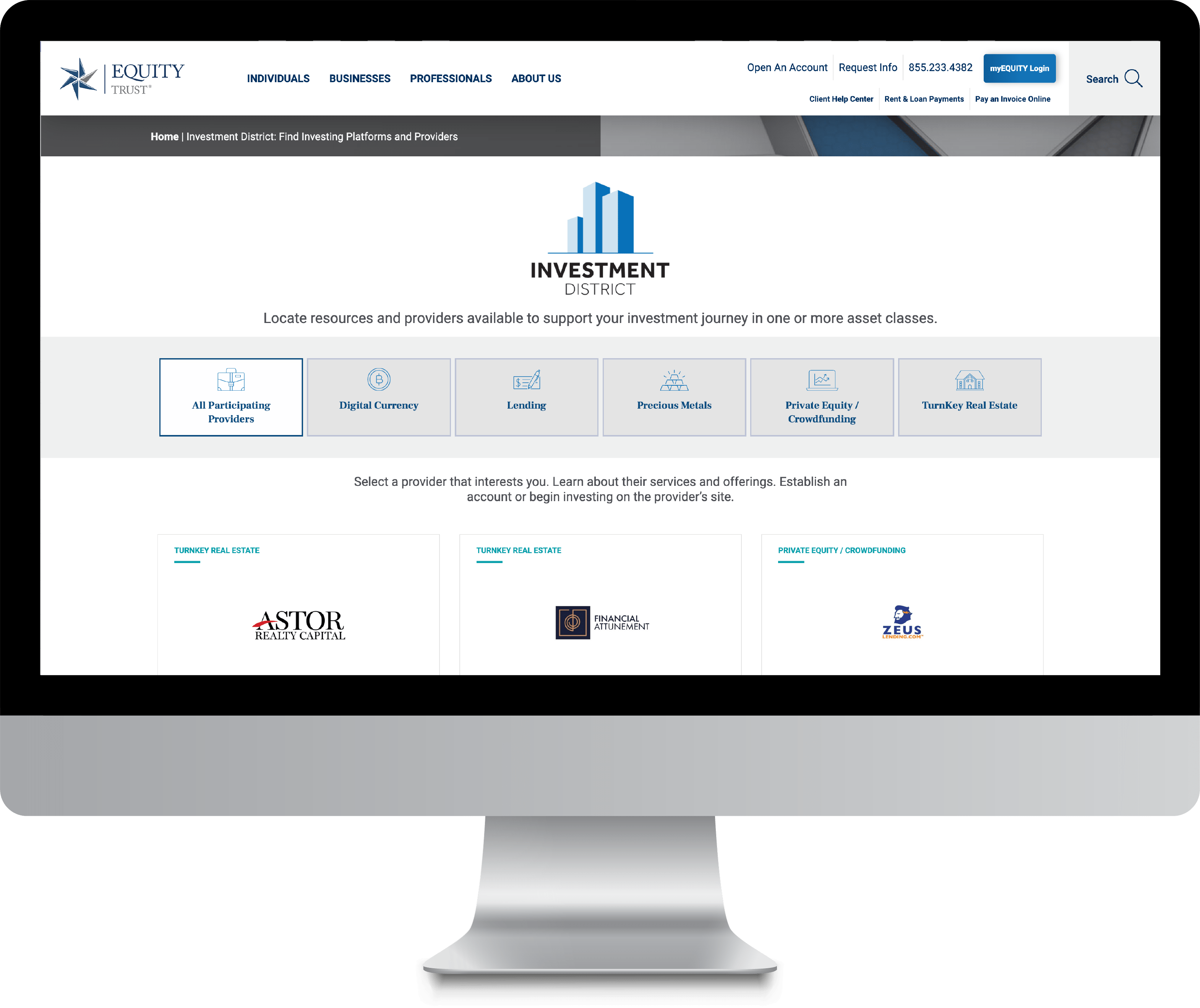

Expand Your Reach with Investment District

Talk to us about potentially extending your offering with Investment District, our online marketplace. EquityConnect users who qualify can increase exposure among investors with funded accounts seeking their next opportunity.

- Investors can browse and choose from listed platforms and providers in the cryptocurrency, lending, precious metals, private equity/crowdfunding, and turnkey real estate asset classes

- Publish your company logo, description, and materials on the Investment District site and be immediately visible to one of the industry’s largest audiences

- Feature-rich: Intuitive and easy-to-find investment categories and search capabilities

- Actively visited by Equity Trusts clients via multiple channels including emails, portals, and website

- Easily access reporting metrics and more

Streamlined Self-Directed IRA Investments for Asset Sponsors and Investors

Equity Trust’s integration with SponsorCloud, a leading Real Estate Investment Management Platform, automates the entire business cycle for raising capital and managing investor relations in private real estate investments.

Through this integration, asset sponsors can:

- Shorten the time to fund

- Streamline the required documentation

- Optimize the user experience for sponsors and investors

Discover how your business could benefit from this technology.

Request a Demo

Discover how Equity Trust could help you tap into the vast funding potential of retirement accounts: Request a demo today.

By entering your information and clicking Start a Conversation, you consent to receive reoccurring automated marketing emails about Equity Trust’s products and services. This consent is not required to obtain products and services. If you do not consent to receive emails from Equity Trust and seek information, contact us at 855-233-4382.