50% Off All

Education Courses

Happy Financial Literacy Month!

Enjoy half off all education courses

with code: LITERACY

Investor Insights Blog|Mark’s Story Part II: His $45,000 Profit and How He Managed His Investments

Real Estate

Equity Trust Educational Speaker, John Bowens, sat down with our Self-Directed Investor of the Year, Mark from North Carolina, to discuss how he successfully completed his first two investments resulting in $119,000 of tax-deferred profits.

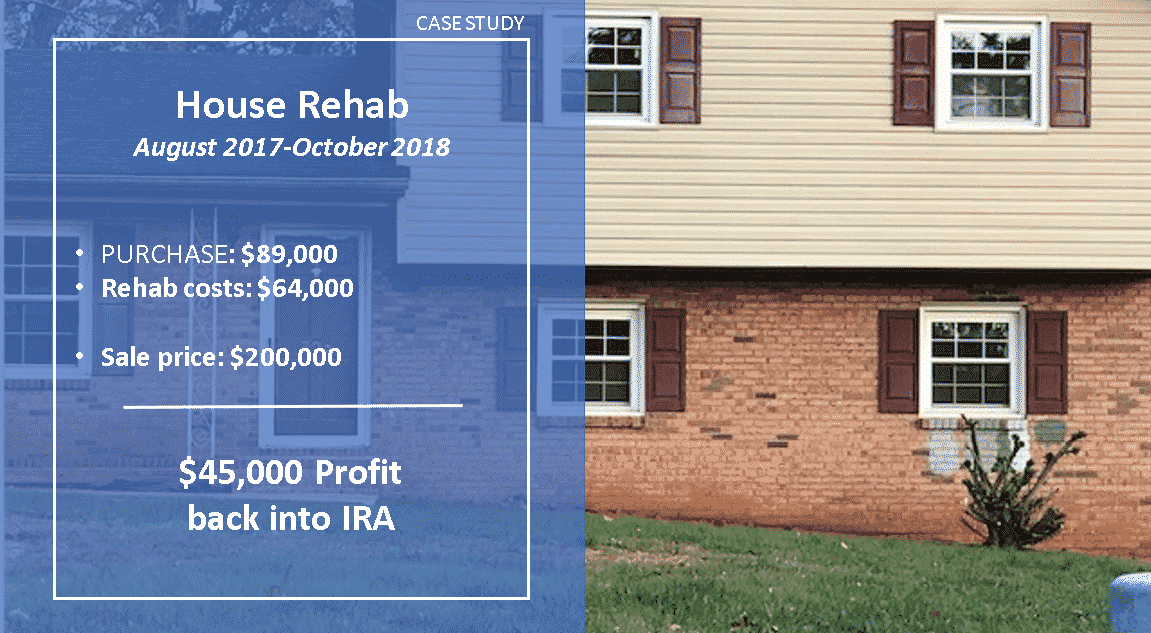

In part two of the interview, Mark walks through his first investment – resulting in $45,000 of tax-advantaged profit – and how he managed his investments in his IRA.

Haven’t read part one yet?

Read how Mark gained confidence and learned about real estate investing in his IRA.

John: Mark, tell us a little bit about your experience with the rehab. Tell us a little bit about how you found your contractors and what that process looked like.

Mark: Sure. Being the very first investment that I’ve ever had, it was difficult finding contractors initially.

And the reason is because I’ve never done this, I didn’t know where to look and it took me a few months to really find first base.

It doesn’t necessarily happen like it does on TV where they rehab a house in 30 to 60 to 90 days.

John: Yeah and I appreciate what you shared with me off-air about identifying a group of like-minded investors in your local market. Could you speak a little bit about how you found that Real Estate Investment Group and how you got yourself plugged into that group?

Mark: I actually brought the realtor out to this house after I purchased it. And he said, you actually need to keep your rehab costs to x, so that you can actually turn a profit.

But more importantly, the other thing that he’s turned me on to is, every Friday morning at 7am there’s a meeting that occurs with all real estate investors, brokers, and agents.

They share information like, here’s a property that I just purchased. I’m looking for somebody to come in and rehab it, or they need somebody to wholesale it, or they need somebody with hard money, or what have you.

There’s all kinds of opportunities. That’s the only chapter that I’ve ever gone to.

So, between my attorney, myself, and we got Equity Trust on the phone, to actually work through the mechanics of the partnership to satisfy all parties. Equity Trust is part of the team too.

John: That’s a great point. Because when you have us as one member of your financial team, alongside the attorney or CPA, realtor, title company, etc., you can have that conference call and we can talk through that.

That being said, the rehab cost $64,000. Mark, did you have a general contractor that you made installment payments to? How did that work in terms of getting that money from the IRA and out to the recipients of those funds?

Mark: You know, the payment wizard in myEQUITY. It is very easy to use.

Now. There’s some bumps in the roads that I had to begin. Mostly, when do you do it?

When do you do it and how do you do it?

Meaning, like I had an HVAC contractor that came in and did a whole new system. And I had a check overnighted to him and he received it on Friday and the job was supposed to be completed on Friday, but they didn’t finish it until Saturday.

And everyone knows you kind of hate paying a contractor before the job’s actually completed. Now, what I have done since then, and what I’ve learned, is I’ll actually still have the check made out to the correct parties, the correct individual. Then I’ll hand the check to the contractor when it’s done. And I’ll send it all overnight to myself, so I have it.

By using the Bill Pay system in myEQUITY, you can do exactly that and just have the check sent to you.

John: Absolutely. So of course, getting into the good stuff here. The rehab costs $64,000, it sold for approximately $200,000, and Mark made a $45,000 tax-advantaged profit.

When I say tax advantaged, this was a Traditional IRA, correct, Mark?

Mark: Correct.

John: Okay, this is what we refer to as a “tax-deductible” or “tax-deferred” account. So, when money was going into there from his contributions or 401(k) contributions, he was receiving tax deductions.

It’s growing tax-deferred and eventually when Mark begins withdrawal of the money, you would pay ordinary income taxes. But the advantage, of course of an IRA is that it’s tax-exempt in the year in which you have that income coming back in.

Hypothetical Example:

Let’s take a look if that $45,000 profit was outside of Mark’s IRA environment or IRA account. Let’s say he had a 20-percent effective tax on that $45,000 profit.

If we do that math, that’s close to $9,000 in taxes. Now, that’s just a hypothetical scenario.

But if you look at ordinary income tax rates on short-term capital gains $45,000, if I had a 20-percent effective tax rate, let’s say state and federal that’s close to $9,000 in taxes. This $45,000, because it’s in an IRA, is captured in that retirement plan and it’s exempt from taxation.

So $45,000 in profit, Mark on the sale of that property, take us through how that process worked for you.

Mark: It was very similar to the whole rehab itself and purchasing it. When I had the contract, we actually sent all the paperwork to Equity Trust to review and make sure that everything was fine.

The only issue was getting the closing attorney’s information so we could actually receive the wire transfer. And once we did all that, it was smooth.

John: Okay, that’s great. It’s important to note here that all that money is going directly back into the retirement plan.

What types of accounts does Equity Trust hold?

When I sell a property owned by my IRA, may I keep a portion of the proceeds and send the remaining portion to Equity Trust?

Can my IRA purchase real estate that I currently own?

Case studies provided are for illustrative and educational purposes only. Past performance is not indicative of future results. Investing involves risk, including the possible loss of principal. Quotes and information included in the case studies and testimonials were provided by the investors and included with permission. Equity Trust Company does not independently verify all information provided by third parties.

You are leaving trustetc.com to enter the ETC Brokerage Services (Member FINRA/SIPC) website (etcbrokerage.com), the registered broker-dealer affiliate of Equity Trust Company. ETC Brokerage Services provides access to brokerage and investment products which ARE NOT FDIC insured. ETC Brokerage does not provide investment advice or recommendations as to any investment. All investments are selected and made solely by self-directed account owners.

Continue