50% Off All

Education Courses

Happy Financial Literacy Month!

Enjoy half off all education courses

with code: LITERACY

Investor Insights Blog|Top Reasons to Save for Retirement

Self-Directed IRA Concepts

If you’re relatively young, the thought of saving for retirement might be the last thing on your mind when it comes to financial priorities. You may be dealing with car payments, mortgages, student loans, children… the list goes on. If you’re not already saving for retirement, you might want to consider starting. Here’s why.

There’s a general rule of thumb that you’ll need 70 percent of what you make at the peak of your career in retirement. This 70 percent mainly deals with your standard of living, such as budget for food, entertainment, living costs, etc. In addition to this, you need to be prepared for unexpected expenses individuals don’t always plan for, such as medical bills or long-term care as you get older.

In the past, many Americans’ retirement plans consisted solely of Social Security. However, in the next 15 years alone, the ability to rely on this form of income in retirement will diminish.

According to the 2020 annual report of the Social Security Board of Trustees, the trust funds that disburse retirement, disability and other Social Security benefits will be depleted by 2035.

It’s also worth noting, “The coronavirus pandemic could also have a significant impact on the system’s long-term finances, as large-scale job losses cut into the payroll tax revenue that largely funds Social Security” according to AARP.

Even if Social Security isn’t completely gone by the time you retire, you will more than likely need an extra 30 to 40 percent of that 70 percent to live comfortably.

While some people find they have fewer expenses in retirement with children moved out and loans paid off, it’s important to consider what your retirement goals entail when it comes to saving for retirement. You might want to travel the world, start a small business from a hobby, purchase a second home on a beach or in the mountains, for example.

When you start saving for retirement at a young age, you potentially allow yourself to have a wider array of options in retirement to achieve these goals and dreams. The sky can be the limit if you start saving early.

Without getting into the nitty-gritty of it, saving for retirement in a tax-advantaged account is a great way to grow your funds in general.

In general, if you contribute to a retirement account:

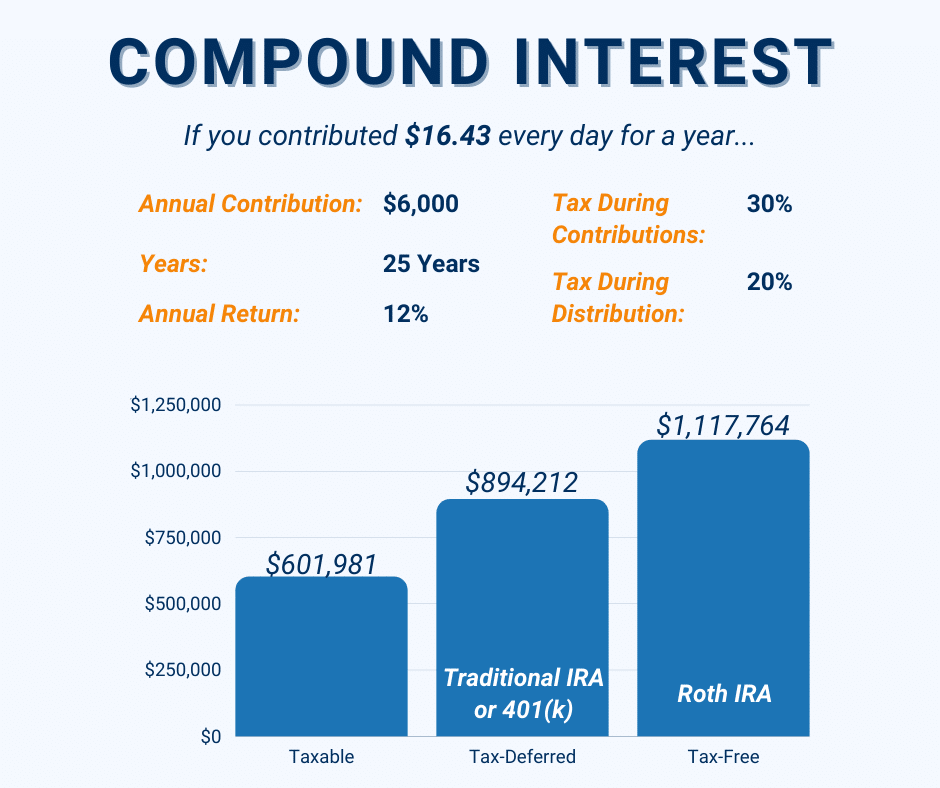

Compound interest can be powerful, so powerful it can stand alone as a reason to start saving for retirement.

Here’s a short example to illustrate the power of compound interest:

Think about how much of an impact compound interest has when you have even longer than 25 years to save in a tax-advantaged retirement account.

Take this example from Investopedia:

“Let’s say you start investing in the market at $100 a month, and you average a positive return of 1 percent a month or 12 percent a year, compounded monthly over 40 years. Your friend, who is the same age, doesn’t begin investing until 30 years later, and invests $1,000 a month for 10 years, also averaging 1 percent a month or 12 percent a year, compounded monthly. Your friend will have saved up around $230,000. Your retirement account will be a little over $1.17 million.”

If you’re convinced that you should be saving for retirement but you’re not sure where to start, here are some next steps:

1. Decide what type of account you want to open. Does your employer have a retirement plan option? If so, that may be a place to start. You can also look into other custodians, such as Equity Trust. We offer a variety of tax-advantaged accounts.

2. Start making contributions, even if it’s not the full annual limit. A little is better than nothing. (See the annual contribution limits.)

3. Choose investments that feel right and fit your area of expertise. A self-directed IRA at Equity Trust allows you to invest in assets such as real estate, lend money through notes, cryptocurrency, mutual funds and more.

Should I wait to open an account if I don’t have an investment ready right now?

What’s the difference between a self-directed IRA and a traditional IRA?

What investments can I make using a self-directed IRA?

You are leaving trustetc.com to enter the ETC Brokerage Services (Member FINRA/SIPC) website (etcbrokerage.com), the registered broker-dealer affiliate of Equity Trust Company. ETC Brokerage Services provides access to brokerage and investment products which ARE NOT FDIC insured. ETC Brokerage does not provide investment advice or recommendations as to any investment. All investments are selected and made solely by self-directed account owners.

Continue