Many investors believe their retirement savings are limited to mutual funds, stocks, and bonds, assets that rise and fall with the market and often feel beyond their control. Yet an increasing number of Americans are discovering another path—one that gives them more choice, more creativity, and more potential to grow through self-directed IRA investing.

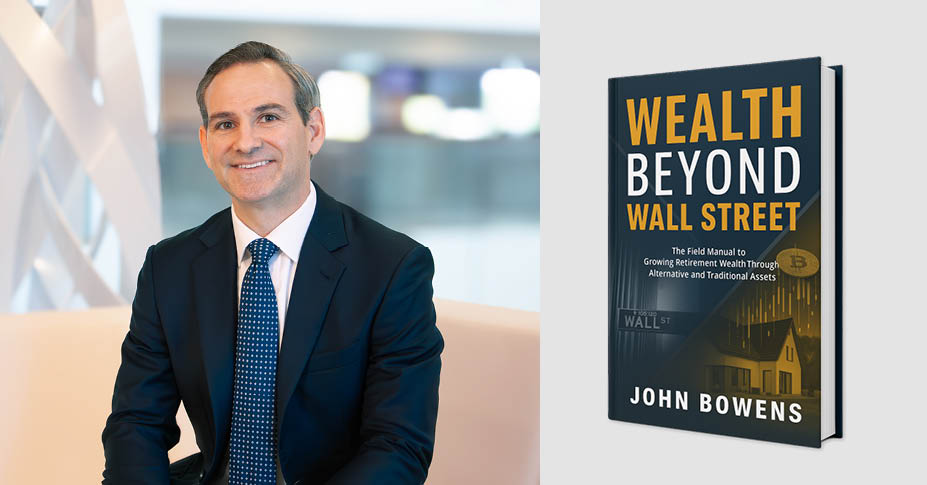

In Wealth Beyond Wall Street: The Field Manual to Growing Retirement Wealth Through Alternative and Traditional Assets, John Bowens, Director and Head of Education and Investor Success at Equity Trust, invites readers into the world of self-directed IRAs (SDIRAs), where investors aren’t confined to Wall Street’s rhythm.

This isn’t just an educational overview; it’s packed with real-world examples and potential methods for those ready to take a more active role in shaping their financial future. From real estate and private lending to other alternative opportunities, John shows how investors can think differently about building wealth while staying within the IRS framework.

What Is a Self-Directed IRA (SDIRA)?

An SDIRA is a retirement account that gives you the freedom to invest beyond traditional Wall Street assets. Unlike employer plans or brokerage IRAs that may limit you to stocks, bonds, and mutual funds, a self-directed IRA allows you to choose from a much wider range of alternative assets, including real estate, private loans, precious metals, and cryptocurrency.

“Self-directed investing allows you to align your investing approach with your passions or values,” John says in Chapter 1 of his book.

You maintain the same tax-advantaged structure of a Traditional or Roth IRA but can direct your dollars toward opportunities beyond Wall Street. This is not a new type of IRA, but it is a new level of control for many investors.

Why Investors Turn to Alternative Assets

Alternative assets provide investors a way to diversify beyond traditional portfolios and potentially build wealth through tangible, real-world opportunities.

Some of the most common SDIRA investments include:

- Rental properties and fix-and-flips

- Private lending and promissory notes

- Real estate partnerships and syndications

- Precious metals and digital currency

- Private equity and start-ups

These assets allow investors to participate in sectors they know and trust.

John’s book offers real-world examples of investors leveraging their personal knowledge to invest in alternative assets within a self-directed plan.

The Tax Benefits That Can Help Build Long-Term Wealth

One of the potential advantages of using an SDIRA is that your gains can compound in the absence of current taxation, meaning more of your profits stay invested and working for you.

Depending on your account type:

- Traditional IRA: Contributions are typically tax-deductible, and earnings grow tax-deferred until retirement.

- Roth IRA: Contributions are made with after-tax dollars, and qualified withdrawals are tax-free — including all gains.

The combination of flexibility and tax benefits that an SDIRA can provide help investors pursue long-term growth within their retirement plan.

Know the Rules Before You Invest

While the opportunities are wide, SDIRAs are subject to IRS rules designed to protect their tax benefits. For example:

- Your IRA can’t invest in property you personally use or rent to a family member.

- All investment income and expenses must flow through the IRA, not your personal funds.

- Certain transactions with “disqualified persons” — such as yourself, your spouse, or direct family members — are prohibited.

John’s explanations of these rules are useful for investors to understand how to keep their accounts compliant.

Inside Wealth Beyond Wall Street

This isn’t another financial textbook. It’s a hands-on field manual designed to help investors understand how they can build and protect retirement wealth using both traditional and alternative assets.

Inside the book, you’ll learn:

Step-by-step process on how to buy real estate with an IRA

- The key SDIRA real estate rules every investor should know

- Real-world examples from investors who grew tax-advantaged rental income

- Ways you can structure private lending, partnerships, and other alternative assets within an IRA plan

- The potential tax advantages of different account types and contribution methods

- Options to combine Roth, Traditional, and even HSA accounts for added flexibility

You’ll also see how investors are using these accounts to help build wealth that can outlast market swings, all while following IRS rules and gaining long-term tax advantages.

Take the Next Step

Your retirement savings shouldn’t be limited by someone else’s menu of mutual funds. With a self-directed IRA, you can take control, invest where you have insight, and unlock the full potential of your retirement plan.

Purchase your copy of Wealth Beyond Wall Street: The Field Manual to Growing Retirement Wealth Through Alternative and Traditional Assets today to learn how self-directed investing can help you pursue greater freedom, flexibility, and financial confidence for the future.