What is a SEP IRA?

A Simplified Employee Pension or SEP IRA is a retirement plan for self-employed individuals or small business owners (up to 25 employees). It enables business owners to make contributions toward their own retirement without getting involved in a more complex plan.

Employers can make pre-tax contributions to their employees’ SEP IRAs, helping them save for retirement. Contributions grow tax-deferred, and employees only pay taxes when they withdraw the funds in retirement.

At Equity Trust, you can self-direct your SEP IRA and invest in a wide range of alternative assets, such as real estate, private equity, and more.

Videos

Benefits of a SEP IRA

High contribution limits: One of the key advantages of a SEP IRA is its significantly higher contribution limits compared to Traditional or Roth IRAs. Employers can contribute up to 25% of an employee’s compensation or the annual maximum set by the IRS, whichever is lower. This allows for substantial retirement savings in a short amount of time.

Tax-deductible contributions: Employer contributions to a SEP IRA are fully tax-deductible, reducing the business’s taxable income. This provides a dual benefit—helping employers save on taxes while contributing to their employees’ retirement savings.

Flexibility in contributions: Employers have the flexibility to decide how much to contribute each year, and there is no obligation to contribute annually. This allows businesses to adjust contributions based on cash flow or financial health while still offering valuable retirement benefits.

Simpler setup and administration: SEP IRAs are easier to set up and maintain than more complex retirement plans like 401(k)s. With fewer administrative burdens and no annual filing requirements, SEP IRAs provide a streamlined option for small businesses and self-employed individuals looking to offer retirement benefits.

Interested in alternative investments but don’t know where to start?

No problem. We make it easy to locate potential investments.

Available through our online account management system, myEQUITY, the WealthBridge portal provides a secure, direct connection to alternative asset investment platforms.

Discover WealthbridgeOur online marketplace introduces you to dozens of asset providers across various investment types including turnkey real estate, private equity, cryptocurrency, precious metals, and more.

Visit Investment DistrictSEP IRA Contribution Limits

The IRS sets annual contribution limits for a SEP IRA, which are the lesser of a fixed dollar amount or 25% of an employee’s compensation. The IRS also sets a maximum compensation limit that can be considered for an employee when calculating contributions.

See the current year’s contribution limits.

SEP IRA Contribution Limits and Deadlines

| 2025 | 2024 | |

| Max Dollar Allocation | $70,000 | $69,000 |

| Max Considered Compensation | $350,000 | $345,000 |

| Contribution Deadline | 4/15/2026 | 4/15/2025 |

The maximum amount that can be contributed to a simplified pension plan (SEP) is 25% of an employee’s compensation, which is capped at a maximum as indicated above.

| 2024 | |

| Max Dollar Allocation | $69,000 |

| Max Considered Compensation | $345,000 |

| Contribution Deadline | 4/15/2025 |

The maximum amount that can be contributed to a simplified pension plan (SEP) is 25% of an employee’s compensation, which is capped at a maximum as indicated above.

SEP IRA Eligibility Requirements

To establish a SEP IRA, you must be a business owner or self-employed individual. Any employer – whether a corporation, partnership, or self-employed individual – may establish the plan, even if there is only one employee.

An employer may set less restrictive requirements than the ones listed but not more restrictive. Employees must meet ALL of the following requirements:

- Be at least 21 years of age;

- Have worked for the business during any three of the past five years; and

- Have earned the $750 annual minimum required compensation.

Spouses and children may also participate in the plan and open their own SEP IRAs – as long as they are employees of the company and meet the income requirements.

SEP IRA Account Rules

No employee contributions: Unlike other retirement accounts, only employers can contribute to a SEP IRA. Employees are not allowed to make their own contributions, but they benefit from the tax-deferred growth of the funds contributed by their employer.

Rollover options: Funds in a SEP IRA can be rolled over into other retirement accounts, such as a Traditional IRA or Roth IRA. This flexibility allows account holders to consolidate their retirement savings or convert their SEP IRA to a Roth IRA, though taxes may apply in the case of a Roth conversion.

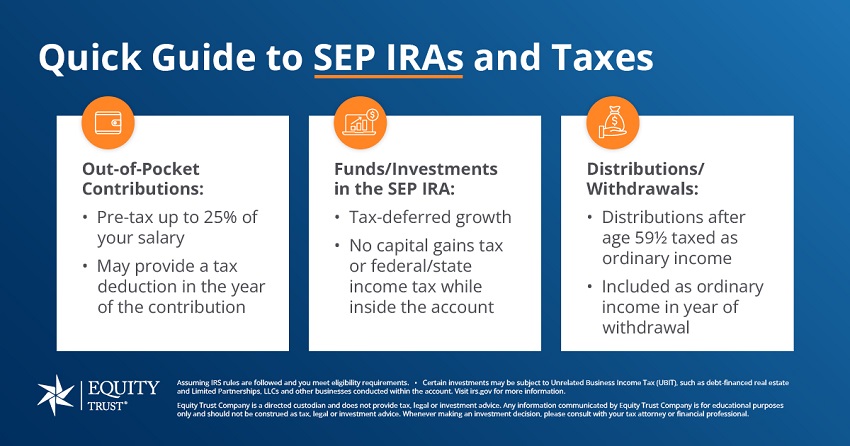

SEP IRA and Taxes

Contributions to a SEP IRA are made with pre-tax income, providing immediate tax savings. These contributions are also tax-deductible, allowing you to reduce your taxable income by the amount you contribute.

The funds in your SEP IRA can grow tax-deferred through potential earnings from investments such as interest, dividends, or capital gains. Taxes are only applied when you withdraw funds in retirement.

SEP IRA vs SIMPLE IRA Comparison

When it comes to retirement savings plans for small businesses, two popular options are the SEP IRA and the SIMPLE IRA. Each offers unique features that can benefit both employers and employees, depending on your business’s needs and financial goals.

The chart below breaks down some key differences between the accounts:

| SEP | SIMPLE | |

| Tax Advantages | Contributions are tax-deductible for the employer, and grow tax-deferred until withdrawal | Contributions are tax-deductible, and funds grow tax-deferred until withdrawal |

| Eligibility | Available to any employer or self-employed individual, including sole proprietors, partnerships, and corporations | Available to businesses with 100 or fewer employees who earned at least $5,000 in the previous year |

| Contribution Limits | Employer contributions up to 25% of compensation or $69,000, whichever is less | Up to $16,000 under age 50 and catch-up contribution of $3,500 over age 50 |

| Employer Contributions | Employers must contribute the same percentage of compensation for all eligible employees | Employers are required to match employee contributions dollar-for-dollar up to 3% |

| Rollover Options | Can be rolled over into another SEP IRA, Traditional IRA, or Roth IRA | Can be rolled over into another SIMPLE IRA, Traditional IRA, or Roth IRA after a 2-year waiting period |

| Qualified Expenses | Can be used for a wide range of medical expenses, including deductibles, copayments, prescriptions, and some over-the-counter medications | Covers similar medical expenses as an HSA but is less flexible with over-the-counter items |

| Who Contributes | Employers only | Employers and employees |

| Withdrawals | Withdrawals before 59½ are taxed as income and incur a 10% penalty | Withdrawals before 59½ incur a 10% penalty, and withdrawals within the first 2 years incur a 25% penalty |

| SEP | |

| Tax Advantages | Contributions are tax-deductible for the employer, and grow tax-deferred until withdrawal |

| Eligibility | Available to any employer or self-employed individual, including sole proprietors, partnerships, and corporations |

| Contribution Limits | Employer contributions up to 25% of compensation or $69,000, whichever is less |

| Employer Contributions | Employers must contribute the same percentage of compensation for all eligible employees |

| Rollover Options | Can be rolled over into another SEP IRA, Traditional IRA, or Roth IRA |

| Qualified Expenses | Can be used for a wide range of medical expenses, including deductibles, copayments, prescriptions, and some over-the-counter medications |

| Who Contributes | Employers only |

| Withdrawals | Withdrawals before 59½ are taxed as income and incur a 10% penalty |

Getting Started with a SEP IRA

Here are the three steps to getting started with an Equity Trust self-directed SEP IRA:

Open your Equity Trust SEP IRA

You can open your SEP IRA online through our account management system myEQUITY, or get personalized assistance from one of our specialized IRA Counselors.

Fund your new tax-advantaged account

Choose from three ways to fund your account: rolling over funds from another retirement account, transferring from an existing IRA, or making an out-of-pocket contribution.

Find your investment and direct Equity Trust to send funds

myEQUITY investment wizards can walk you through submitting your investment online. We’re here to help guide you through the process.

FAQs

Is there a Roth SEP IRA?

No, there is no Roth SEP IRA. Roth IRAs and SEP IRAs are different types of accounts, each with its own rules. A SEP IRA allows for pre-tax contributions from employers, while Roth IRAs are funded with post-tax dollars.

Can I convert a SEP IRA to a Roth IRA?

Yes, you can convert a SEP IRA to a Roth IRA. When you convert, you will be required to pay income taxes on the amount converted, as Roth IRAs are funded with post-tax dollars. Also be aware that a SEP IRA is obtained through an employer, while a Roth IRA is an individual account.

Can I open a SEP IRA in 2025 for 2024?

Yes, you can open and contribute to a SEP IRA in 2025 for the 2024 tax year, provided you do so before your tax filing deadline, including extensions. This gives you flexibility to make contributions to a SEP IRA for the previous tax year.

Can an S-Corp have a SEP IRA?

Yes, an S-Corp can establish a SEP IRA for its employees, including owners of the company. The S-Corp must meet eligibility requirements, and contributions are based on the employees’ compensation. Contributions are made by the business, not by the employees themselves, and must be the same percentage of compensation for all eligible employees.

Who can contribute to a SEP IRA?

Employers are the sole contributors to a SEP IRA. Employees cannot make direct contributions to the account, but they benefit from the employer’s contributions, which are based on a percentage of their compensation. Employers have the flexibility to contribute to employee SEP IRAs each year, and contributions are discretionary, meaning there is no requirement to contribute every year.

Are SEP IRA contributions tax-deductible?

Yes, employer contributions to a SEP IRA are fully tax-deductible for the business. This helps reduce the company’s taxable income while benefiting the employees by funding their retirement savings. The contributions made on behalf of employees are also tax-deferred, meaning employees won’t pay taxes on the contributions until they make withdrawals in retirement.

When can you withdraw from a SEP IRA without penalty?

You can withdraw from a SEP IRA without penalty starting at age 59½. If you withdraw funds before this age, you will likely incur a 10% early withdrawal penalty, in addition to income taxes on the amount withdrawn. After age 59½, you can withdraw money from the account without penalty, but withdrawals are still subject to regular income tax.

Can you roll a 401(k) into a SEP IRA?

Yes, you can roll over funds from a 401(k) into a SEP IRA. This process allows you to consolidate retirement accounts, which can simplify managing your investments. The rollover must follow IRS rules to avoid taxes or penalties.